Single-Family Rent Growth Declines for 10th Straight Month

CoreLogic, Irvine, Calif., said single-family rent price growth continued its slowing trend in February as it dropped to a 5% growth rate.

“Rental cost growth relaxed again in February but is still increasing nationwide year over year,” said Molly Boesel, Principal Economist with CoreLogic. She said single-family rental prices are increasing by about 8% annually, well below the rates 20% to 40% rates seen a year ago.

Metro-level trends indicate renters are seeking more affordable areas, CoreLogic said in its monthly Single-Family Rent Index. For instance, St. Louis, historically one of the least expensive rental markets CoreLogic studies, ranked at the bottom for gains in February 2022 but topped the index for growth in February 2023.

Western metros that posted substantial rent price increases one year ago have seen appreciation relax over the past year, CoreLogic reported. In February 2022, Phoenix and Las Vegas ranked in the top five for annual rent price growth, 18.2% and 16.6%, respectively. One year later, those two metros sit at the bottom for increases. These rental price trends reflect general housing market dynamics, with CoreLogic’s latest Home Price Index finding highly populated Western metros posted mostly flat price changes year-over-year in February.

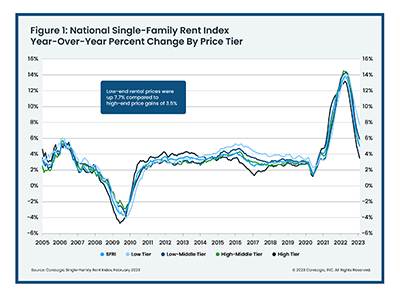

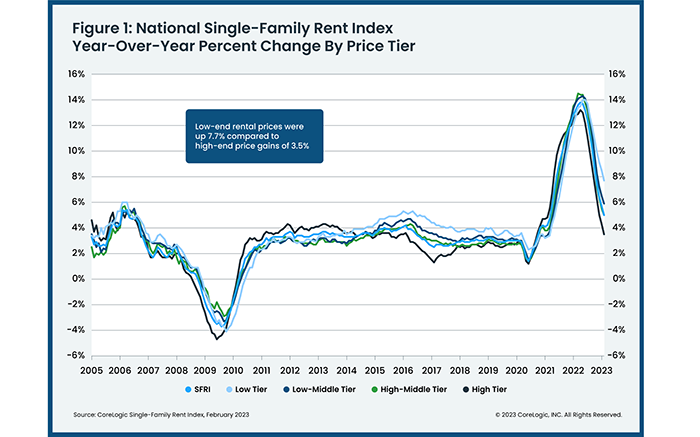

Other report findings:

• Lower-priced (75% or less than the regional median): 7.7%, down from 12.7% in February 2022

• Lower-middle priced (75% to 100% of the regional median): 5.9%, down from 13.8% in February 2022

• Higher-middle priced (100% to 125% of the regional median): 5%, down from 13.8% in February 2022

• Higher-priced (125% or more than the regional median): 3.5%, down from 12.8% in February 2022

• Attached versus detached houses: Attached single-family rental prices grew by 5.6% year-over-year in February compared with the 3.9% increase for detached rentals

Of the 20 largest U.S. metros, St. Louis posted the highest year-over-year increase in single-family rents in February at 7.8%. Charlotte, N.C. and Orlando, Fla. registered the next highest annual gains, both at 7.7%. Las Vegas and Phoenix saw the lowest annual rent price growth, both registering 0.3%.