LightBox: Interest Rates, Inflation Top CRE Threats

Rising interest rates and inflation remain the top threats to the commercial real estate industry, said LightBox, New York.

“As complex economic issues continue to impact capital markets activity, investors are searching for investment bright spots in murky economic conditions,” Tina Lichens, Senior Vice President of Broker Operations with LightBox, said in the firm’s Investment Sentiment report. “Market fundamentals still support a broad range of investment activity, but the more immediate question is how long any market downturn will last.”

Looking at commercial real estate market expectations for the balance of 2022 and 2023, the bears are gaining ground, with 70% of industry professionals calling themselves either concerned or bearish for 2022, higher than those that are bullish or optimistic (30%). The level of optimism improves for 2023, but still includes more concerned or bearish respondents (58%) versus bullish or optimistic ones (42%), the report said.

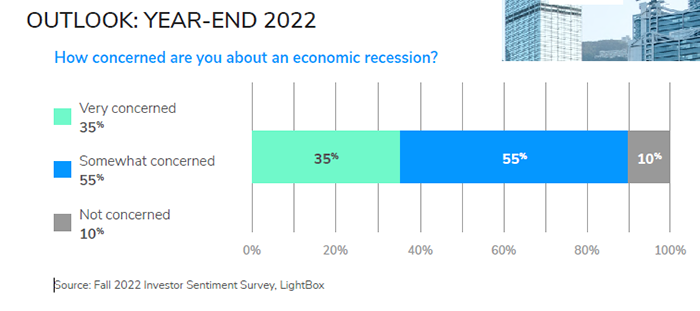

“As the Fed continues its efforts to raise interest rates to tamp down inflation, there is growing concern about whether that approach will produce the desired results without triggering a recession,” LightBox said.

The U.S. unemployment rate remains below 4%, but companies are starting to feel pressure from rising interest rates, high inflation and other issues, LightBox noted. “There are signs of an uneven outlook as some companies shed workers in response to changing economic conditions and other factors,” the report said. For example, U.S. technology firms announced 42,000 layoffs as of September following a robust year for hiring.

“Heading into year-end, interest rates–and their impact on transaction volume and, ultimately, taming inflation–are the key variables impacting the flow, mood and outlook for commercial real estate,” LightBox said. “Given the uncertainty around future increases and whether fiscal policy succeeds in controlling inflation without a recession, many investors, brokers and lenders are expecting pricing to adjust.”

Survey participant Mike Davis, Executive Vice Chair in Cushman & Wakefield’s Tampa office, said markets need to settle in and find new price points that reflect the current environment. “Once yields adjust from the peak, then capital and lending sources will get comfortable and we’ll see increased momentum,” he said.