Economic Uncertainty, Remote Work Challenge Office Sector

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

In a report, Office Lease Roll: Markets and Transactions Examined, KBRA said all commercial real estate will generally be negatively affected by higher interest rates and recessionary forces. But properties with short-term leases such as hotels, self-storage and multifamily will likely better withstand inflation because they can increase rents as costs increase.

“Office properties, however, generally have longer lease terms that can range from five to 10 years,” said Larry Kay, Senior Director of CMBS Surveillance with KBRA.

The report called the office sector’s longer leases a “double-edged sword” because their ability to keep pace with higher inflation can be significantly reduced. “On the other hand, longer lease terms have helped landlords stay afloat during the pandemic and can benefit landlords in recessionary environments, as tenants locked into long-term leases generally have a legal obligation to pay rent through lease expiration–regardless of how much space is utilized,” KBRA said.

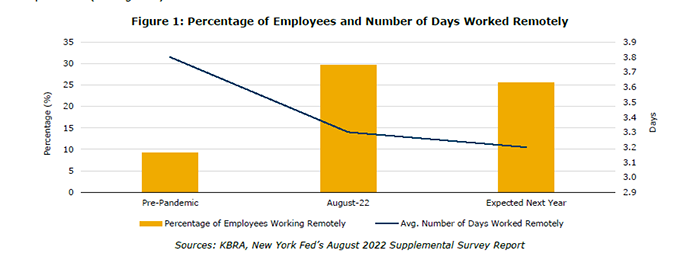

Remote work poses another threat to the office sector, KBRA said. In a recent Federal Reserve Bank of New York survey, businesses estimated the percentage of time an employee worked remotely at least part of the week. The survey compared pre-pandemic to current data and projections for one year from now. It estimated 30% of employees now work remotely for an average of 3.3 days, up from 9% before the pandemic.

“The increase in remote work has led to a consensus among market participants that as leases roll, there will be more distress in the office sector as some tenants may reduce their space needs, negotiate lower rents or not renew at all,” KBRA said. “These could weigh on operating cash flows and a borrower’s willingness to make debt service payments. However, for leases that successfully renew, rents could be increased in an inflationary environment. Unfortunately, this may not be sufficient to overcome the headwinds faced by struggling office absorption in light of remote work trends and economic growth concerns.”