Fitch: Most Maturing CMBS Conduit Loans Can Refinance

Maturing commercial mortgage-backed securities loans have elevated refinancing risk due to rising interest rates and a weakening macroeconomic outlook, reported Fitch Ratings, New York.

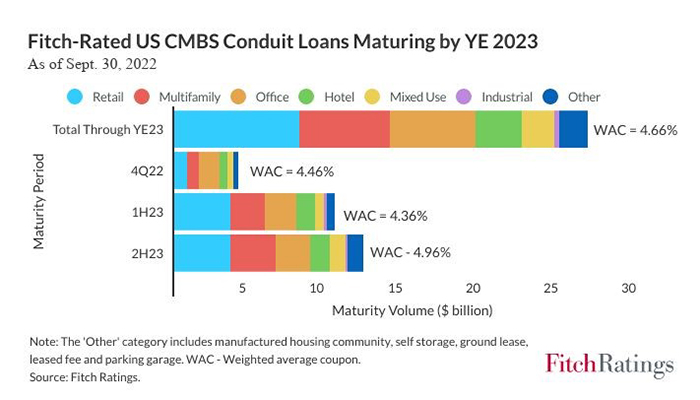

But more than 75% should be able to refinance under three possible scenarios, Fitch said in Rising Rates Stress Refinanceability of Maturing U.S. CMBS Conduit Loans. The report said nearly $26.5 billion in non-defaulted and non-defeased conduit and agency loans within Fitch-rated multi-borrower transactions will maturing by year-end 2023. The weighted-average coupon rate equals 4.70%, well below current market rates.

Fitch studied the loans under three plausible scenarios to determine whether they would meet debt service coverage ratio and loan-to-value parameters needed to secure refinancing. At a 6.75% interest rate, 65% to 68% of the maturing loan volume can satisfy the two DSCR scenarios. Looking at loan-to-value ratios, Fitch said at a maximum 75% LTV, 72% would be able to secure refinancing based on current market capitalization rates.

But 23%, or $6.2 billion, of maturing volume would not be able to refinance under any of the scenarios, Fitch noted. “Net operating income growth averaging at least 1.5 times current in-place NOI, or a new equity infusion that deleverages existing debt by at least one-third, on average, would be needed to pass the refinancing thresholds,” the report said.

Fitch said it expects servicers will grant loan modifications and extensions for stable performing assets and those with committed borrowers. “Fitch believes servicers are appropriately staffed to address the $6.2 billion of potential maturity defaults for loans unable to refinance under any of the scenarios, which is below the peak volume of coronavirus-related transfers to special servicing in 2020 and 2021,” the report said.