Berkadia: Single-Family Rental Sector Evolves

Berkadia, New York, said the single-family rental market is evolving due to growing institutional investment and work-from-home trends.

“An influx of private and institutional capital to the single-family rental space is reflected in a steeply declining rental yield found not only nationally, but across key metros,” Berkadia said in A Closer Look at the U.S. Single Family Rental Market. “In addition to scattered single-family rentals, built-for-rent communities are becoming increasingly popular, where single-family homes are developed with the strict intention to rent.”

In addition, work-from-home trends spurred by the pandemic contribute to a renter population that finds single-family rentals more attractive than ever, the report said.

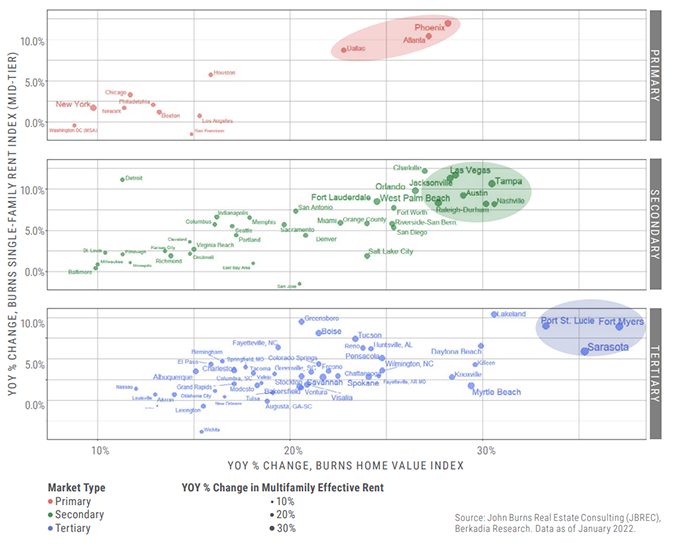

Berkadia noted strong growth in primary markets including Phoenix, Atlanta and Dallas. “[But] higher rates of growth in single-family rental home values and rents are found in secondary and tertiary markets,” the report said. “Tertiary markets such as Fort Myers, Lakeland, Sarasota and Port St. Lucie [Fla.] show outsized growth in rent and values. Compared to their primary and secondary counterparts, growth in home values in tertiary markets is particularly strong.”

Looking just at rent growth, secondary and tertiary markets outperform in this respect relative to primary markets. “Sun Belt markets are disproportionately represented in the set of markets with high rent growth,” Berkadia said.

The relationship between single-family rental rent growth, home value growth and mortgage rates has also evolved, the report said, noting rather flat trendlines for the periods 1985 to 1990 and 1990 to 2009 but steeply negative trendlines since the Great Recession, “implying small movements in rates have large impacts on single-family rent and home value growth. In this sense, single-family rental in the post-Great Recession era is more sensitive to mortgage rates,” Berkadia said.

Depending on which five-year period studied, single-family rental growth rates have a different relationship with inflation. “In some periods, rising inflation means declining [single-family rental] growth rates, but in others the opposite is true,” the report said. “Most recently, Fort Myers and Charlotte are benefiting the most from rising inflation–rising inflation implies rising rental growth rates to the greatest extent. All other markets have recently seen rising growth rates under rising inflation but to lesser extents than seen in Fort Myers and Charlotte.”

Smaller “mom-and-pop operators,” still dominate this market, Berkadia said. “[But] we expect the single-family rental market to continue its evolution into an institutional space, and rapidly so.”