DLA Piper: Bullish Commercial Real Estate Sentiments Despite Global Instability

Ongoing economic uncertainty has not hindered broader optimism about the future for commercial real estate, reported DLA Piper, New York.

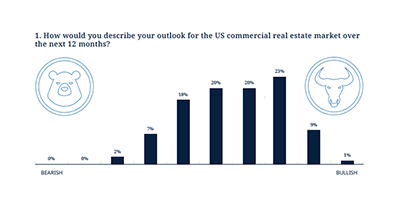

The firm’s annual State of the Market survey asked commercial real estate leaders about the pandemic recovery, economic outlook, attractiveness of investment markets and their overall expectations over the next 12 months. It found continued optimism, with most respondents feeling bullish due to COVID-19 restrictions being lifted in most markets globally.

While general bullishness remains consistent with last year’s survey at 74 percent, more respondents said they have increased confidence about the real estate industry’s next 12 months. A major reason for this year’s positive outlook: an abundance of capital in the market, with 52 percent of respondents citing that as their primary source of confidence, up 17 percentage points from last year.

“Continued increases in optimistic sentiment from respondents speak to the resiliency of the commercial real estate sector,” said John Sullivan, U.S. Chair and Global Co-Chair of DLA Piper’s Real Estate practice, “Despite inflation concerns, rising interest rates and an ever-evolving future of in-office work, we expect most commercial real estate sectors to strengthen over the next year.”

Continuing the trend from recent surveys, logistics, warehousing and cold storage remain the most attractive risk-adjusted investment opportunities in commercial real estate, with 66 percent of respondents ranking them highest among all asset classes. Multifamily also ranked among the most popular investment opportunities in the U.S. for 2022 with 57 percent of respondents ranking it highly, marking an eight percentage-point jump since last year.

Sullivan noted lingering pandemic concerns, high prices and shifting demographics have many commercial real estate investors turning to emerging growth markets such as those along the Sunbelt as targets for future investment. “That is not to say that traditional hubs have been completely abandoned,” he said. “Major investors as well as tech and entertainment companies have made substantial investments in ESG-friendly buildings located in major urban areas as competition increases for the best-in-class assets in large markets.”

These changes create new opportunities in commercial real estate, the report said. “They disperse growth across the U.S., strengthening the broader economy and creating safeguards that lend themselves to a more resilient real estate landscape built to withstand future disruptions.”

Sullivan said the survey underscores that the outlook for commercial real estate remains positive and that industry leaders are increasingly bullish. “The recovery from the pandemic has been nothing short of remarkable in its speed and strength and is evidence of the attractiveness and durability of commercial real estate as a global asset class,” he said.