Single-Family Rent Growth Hits One-Year Record High in March

CoreLogic, Irvine, Calif., said U.S. single-family rent price growth continued its record pace in March, up 13.6 percent from one year earlier.

Slim inventory continues to squeeze renters, as do robust house price gains, both familiar culprits in declining affordability, the CoreLogic Single-Family Rent Index reported. As in recent months, warmer areas of the country experienced the highest single-family rental cost growth, with prices in two large Florida metro areas accelerating at about two-to-three times the national rate.

The year-over-year rent price growth once again more than tripled the gain recorded in March 2021 and more than quadrupled the increase from March 2020, CoreLogic reported. Rent price appreciation slowed in early 2020 due to the uncertainty surrounding the COVID-19 pandemic but rebounded by that fall to surpass its pre-pandemic rate.

“A shortage of single-family properties available for rent has plagued the market, pushing rents up at record-level rates,” said Molly Boesel, Principal Economist with CoreLogic. “The number of single-family rental properties listed in early 2022 was well below pre-pandemic levels and still shrinking from one year ago.”

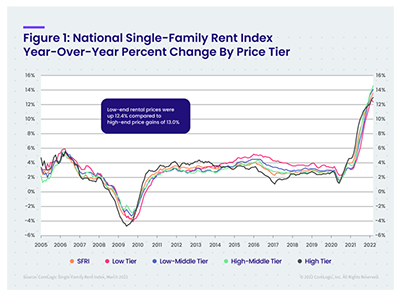

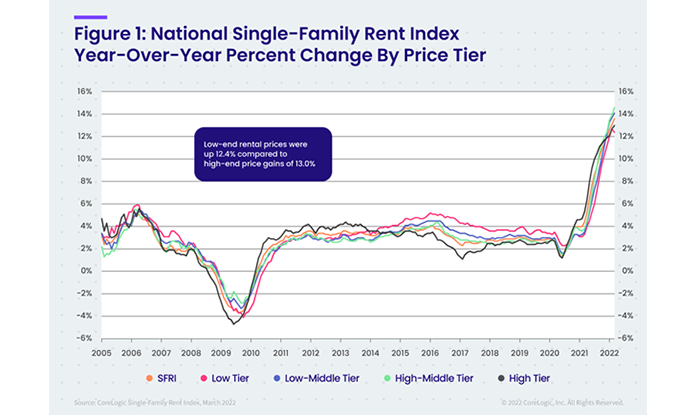

CoreLogic examined four tiers of rental prices. National single-family rent growth across the four tiers and their year-over-year changes equaled:

- Lower-priced (75 percent or less than the regional median): 12.4 percent, up from 3.3 percent in March 2021

- Lower-middle priced (75 percent to 100 percent of the regional median): 14.1 percent, up from 3.5 percent in March 2021

- Higher-middle priced (100 percent to 125 percent of the regional median): 14.6 percent, up from 3.8 percent inMarch 2021

- Higher-priced (125 percent or more than the regional median): 13 percent, up from 5.3 percent in March 2021

Among the 20 largest U.S. metros, Miami once again posted the highest year-over-year increase in single-family rents in March at 40.7 percent, more than 10 times its 3.8 percent annual growth rate in March 2021. Orlando, Fla., and Phoenix recorded the second- and third-highest gains at 24.6 percent and 18.6 percent, respectively, as Americans continue to seek warmer climates. Those three metro areas have experienced the country’s largest year-over-year rent increases since December 2021.

Washington, D.C. (7.6 percent) and St. Louis (7.5 percent) recorded the lowest annual rent price growth in March, CoreLogic said.

Differences in rent growth by property type emerged after the pandemic took hold as renters sought standalone properties in lower-density areas. This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals was more moderate. However, as rental inventory remains slim, the gap between attached and detached rental growth started to close last fall, CoreLogic noted. In March, attached rental property prices grew by 13.2 percent year over year, compared to the 13.3 percent increase recorded for detached homes.

In a separate report, Berkadia, New York, credited growing institutional investment and the work-from-home trend with boosting the single-family rental market. “We expect the single-family rental market to continue its evolution into an institutional space, and rapidly so,” Berkadia said in A Closer Look at the U.S. Single Family Rental Market.