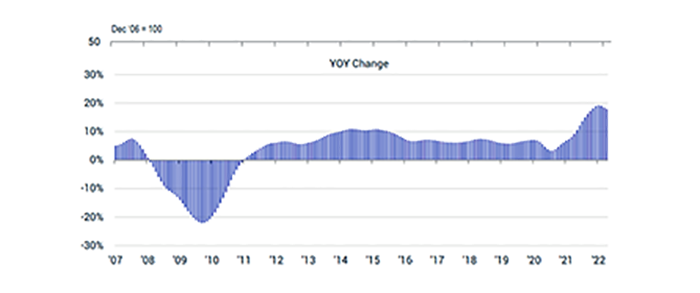

Commercial Real Estate Price Growth Rate Slips

U.S. commercial property price growth ebbed again in April, the third consecutive month of decelerating price gains, reported Real Capital Analytics, New York.

The RCA Commercial Property Price Index rose 0.5 percent in April from March, suggesting only a 6.3 percent annualized pace of growth.

RCA Senior Analyst Michael Savino said the RCA CPPI National All-Property Index rose 17.9 percent from a year ago, a pace still not far from the record rates seen at the start of 2022. Results across the major property types were mixed.

“The industrial and apartment sectors led annual price gains in April, hovering close to their record highs,” Savino said.

Industrial prices rose 26 percent from a year ago and apartment prices increased 23 percent, RCA reported. Both the industrial and apartment indexes rose 1.3 percent from March, suggesting a nearly 17 percent annualized rate of growth, slower than the posted pace of yearly change for these indexes.

The RCA CPPI for retail properties increased 18.4 percent in April from a year ago. “While this rate was close to the record pace seen at the start of the year, it has decelerated for three months in a row,” Savino said. “Retail prices were falling for most of 2020 during the worst parts of the pandemic.”

The price index for central business district offices rose 12.3 percent from a year ago, eclipsing the price increases for suburban offices and marking the fastest annual growth rate for this property type since 2014, RCA reported. Growth in the suburban-office price index has slowed since peaking in late 2021 and in April posted a 10.3 percent year-over-year increase.

Green Street, Newport Beach, Calif., reported its Commercial Property Price Index of properties owned by real estate investment trusts held steady in April. The index is up just 0.2 percent so far this year after rising 24 percent last year.

“Commercial property prices are not going up anymore, but for the most part, they’re not going down either,” said Peter Rothemund, Co-Head of Strategic Research with Green Street. “That’s about as good as one could hope for in this environment, and a lot better than bonds and stocks, which have both lost about 10 percent in value as interest rates have increased.”