Commercial Real Estate Sees Double-Digit February Price Growth

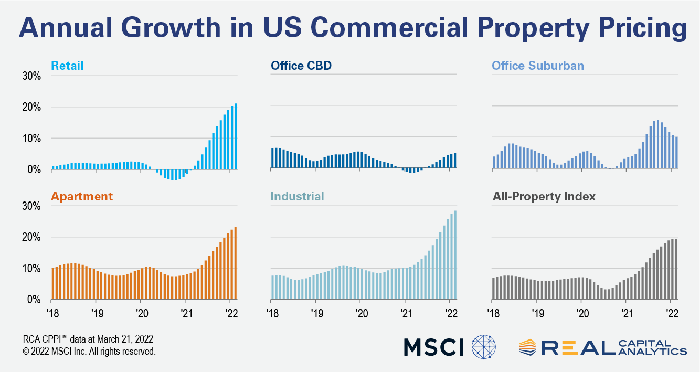

Commercial property price growth continued in February as all four major property types posted double-digit annual price growth, reported Real Capital Analytics, New York.

Real Capital Analytics Senior Analyst Michael Savino said the firm’s National All-Property Index rose 19.4 percent from a year ago and 0.8 percent from January.

Commercial property price growth continued in February as all four major property types posted double-digit annual price growth, reported Real Capital Analytics, New York.

Industrial prices are up 28.5 percent compared to a year ago, the fastest annual rate among the major property sectors and a record for any property type since RCA started tracking property prices. “In June 2021 industrial price growth surpassed its previous high seen prior to the Global Financial Crisis, and growth has accelerated every month since,” Savino said.

Apartment prices registered the fastest pace RCA has seen for that sector as the annual rate accelerated to 23.2 percent. “Cap rates for both the apartment and industrial sectors, as measured by the RCA Hedonic Series, have compressed to record lows,” Savino said.

RCA reported the retail index posted a 21.1 percent annual increase.

But Peter Rothemund, Co-Head of Strategic Research with Green Street, Newport Beach, Calif., said commercial real estate’s red hot appreciation rate will likely cool in the near future.

“It’s been a remarkable run for commercial property, but with interest rates higher, equity markets lower and now the strains of warfare in Ukraine, investors should expect price increases to slow,” Rothemund said. “Because things were so hot before and real estate was so cheap versus the bond markets, bidders may push pricing a little more, but for the most part, investors should expect real estate values to stabilize.”

The Green Street Commercial Property Price Index of properties owned by real estate investment trusts increased 0.1 percent in February. The firm’s all-property index declined 10 percent during the early months of the Coronavirus pandemic, but robust price appreciation since then has pushed the index to record levels.

CoStar, Washington, D.C., reported CRE transaction volume fell in February to its lowest figure in the past 12 months. The slowdown was much more noticeable in the investment-grade segment of the market, where transaction volume fell 27.5 percent month-over-month, compared to a 14.2 percent decline in the general commercial segment.

“Transaction volume can be seasonal, with the highest volume occurring in December of each year and the early months of the following year seeing a steep drawdown of trading activity,” CoStar said. “Activity in December 2021 was historically high, so the decline in January and February 2022 volume was not unexpected.”

CoStar also reported net absorption continued its post-pandemic recovery in February. Net absorption across the office, retail and industrial property types could exceed 452 million square feet for the 12 months ending in March–a 61.9 percent increase over net absorption during the 12 months ending in March 2019, just before the pandemic upended market fundamentals.