CBRE: Cap Rates Down Across Real Estate Spectrum in 2021

Commercial real estate capitalization rates declined across the real estate spectrum last year, reported CBRE, Dallas.

The CBRE Cap Rate Survey found the industrial sector saw the most cap rate compression in 2021, driven by “supercharged” e-commerce and rent growth amid the pandemic. The multifamily sector also saw notable cap rate compression, particularly in suburban areas.

“While this was likely attributable to more people migrating to the suburbs during 2020, many renters have now returned to urban neighborhoods and occupancies there have largely returned to pre-pandemic levels,” the report said.

CBRE said investors will likely continue to target real estate for attractive returns compared to other asset classes and increasingly as an inflation hedge. The firm forecasts investment volumes to increase 10 percent this year compared to 2021.

“As the U.S. heals from the pandemic, investors demand for real estate has grown to new heights,” said Tom Edwards, Global President of Valuation & Advisory Services for CBRE. “Low cap rates for industrial and multifamily properties reflect solid fundamentals and rent growth prospects that characterize these sectors. Conversely, lingering uncertainty in the office sector suggests there is upward pressure for yields in this asset type.”

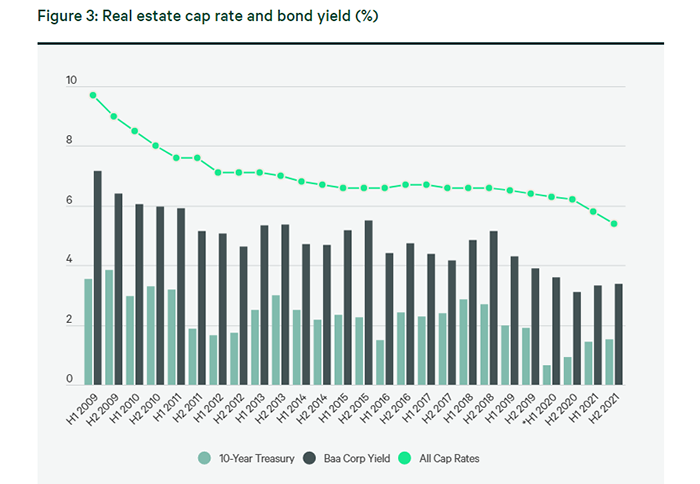

Falling bond yields in 2021 benefited real estate valuations, especially among sectors such as industrial and multifamily that have robust net operating income expectations, CBRE said. Spreads between cap rates and bond yields have historically driven both investment flows into property markets and cap rate compression. In addition, aggressive monetary stimulus weighed on interest rates starting in 2020 and contributed to declining cap rates throughout 2021. CBRE expects the 10-year Treasury yield to increase to 2.3 percent this year, which it called a level likely to maintain a healthy spread relative to real estate cap rates.

“Strong property market fundamentals, fueled by a robust economic recovery, will help maintain cap rates at current levels,” said Richard Barkham, Global Chief Economist and Americas Head of Research for CBRE. “While the crisis in Ukraine and associated sanctions bring some near-term uncertainty into play, we do not currently believe that will be too disruptive to the U.S. economic outlook.”

CBRE noted it conducted the survey data-gathering before the Russia-Ukraine situation intensified in late February.