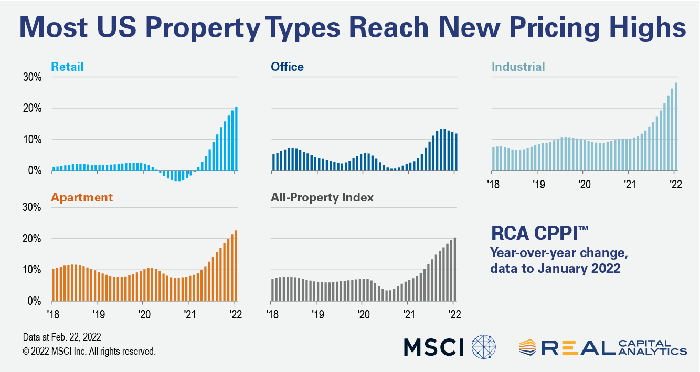

Commercial Property Prices Reach New Highs

Real Capital Analytics, New York, reported U.S. commercial property price growth continued to appreciate at a double-digit pace in January.

The RCA National All-Property Index climbed 20.3 percent from a year earlier and 1.6 percent from December, Real Capital Analytics Senior Analyst Michael Savino said. He noted the price index for industrial properties rose a record 28.1 percent from a year ago, the fastest annual rate among the major property sectors.

The index for retail properties increased 20.4 percent year-over-year, also a record pace, and apartment sector prices posted a 22.5 percent annual gain, RCA reported.

Savino noted apartment property prices in January were 136 percent higher than their peak set just ahead of the Great Recession, far outpacing the next highest sector, industrial.

“Price gains for the office sector lagged in January,” Savino said. The office index rose 11.8 percent year-over-year, a fourth successive month of ebbing annual growth. “While central business district office price gains are creeping higher, suburban office price growth has lost steam in recent months,” he said.

CoStar Group, Washington, D.C., said transaction volume fell to its lowest level in eight months as investment activity “cooled” in January. “The pullback was comparable in both the investment-grade segment and the commercial-grade segment,” CoStar said in its Commercial Repeat Sale Indices report.

Distressed sales as a percentage of all sales fell to 1.2 percent in January, its lowest level since at least January 2008, CoStar said. “This was largely due to the fall in the share of investment-grade distressed sales but suggests that the market may have been less liquid given the slim transaction volume overall,” the report said.

Market liquidity measures indicate buyer and sellers are settling on a sales price more easily, CoStar reported. The average time on the market fell for the fifth time in January to 218 days, the lowest level since June 2020. “Meanwhile, the share of properties withdrawn from the market by discouraged sellers fell,” CoStar said. “The combination of these indicators suggest that buyers and sellers are reaching, and concluding, deals more quickly.”