Construction Posts 6th Straight Monthly Gain

Monthly construction spending started the year strongly, increasing for the sixth consecutive month, the Census Bureau reported Tuesday.

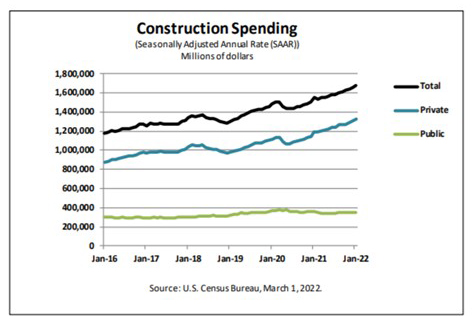

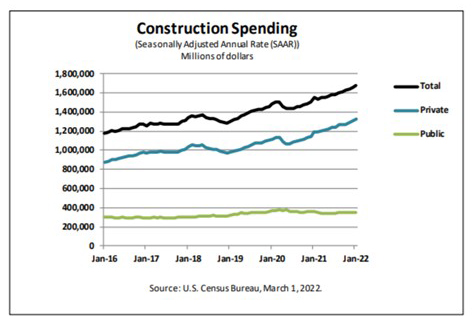

The report said total construction spending during January rose to a seasonally adjusted annual rate of $1,677.2 billion, 1.3 percent higher than the revised December estimate of $1,655.8 billion and 8.2 percent higher than a year ago ($1,549.8 billion).

Spending on private construction rose to a seasonally adjusted annual rate of $1,326.5 billion, 1.5 percent higher than the revised December estimate of $1,307.1 billion. Residential construction rose to a seasonally adjusted annual rate of $829.4 billion in January, 1.3 percent higher than the revised December estimate of $819.0 billion. Nonresidential construction rose to a seasonally adjusted annual rate of $497.2 billion in January, 1.8 percent higher than the revised December estimate of $488.2 billion.

Public construction spending improved as well. The estimated seasonally adjusted annual rate of public construction spending rose to $350.7 billion, 0.6 percent higher than the revised December estimate of $348.7 billion. Educational construction was unchanged at a seasonally adjusted annual rate of $80.9 billion. Highway construction fell to a seasonally adjusted annual rate of $105.3 billion, 0.1 percent below the revised December estimate of $105.5 billion.

“January’s strong gain was broad-based,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Upward revisions to the prior month’s data show that spending ended 2021 with more momentum than previously thought.”

Dougherty noted despite higher mortgage rates and fast-rising home prices, buyer demand continues to be strong. “Exceptionally low inventories of existing homes for sale have boosted builder confidence amid ongoing material and labor shortages,” he said. “Multifamily spending declined 0.1% in January, mirroring the modest drop in multifamily starts experienced during the month. Despite the decline, new apartment construction is ramping up as developers remain encouraged by the prospects for robust rental demand alongside higher mortgage rates and reduced single-family affordability.”

The report also said home improvement spending picked up 1.8%. “Relatively few trade-up options, as well as rising homeowner equity and low interest rates, have encouraged homeowners to move forward with additions and renovation projects,” Dougherty said. “Home improvement spending may downshift somewhat as COVID risks subside and less time is spent at home.”