Hot Small-Cap Commercial Real Estate Market Shows Signs of Cooling

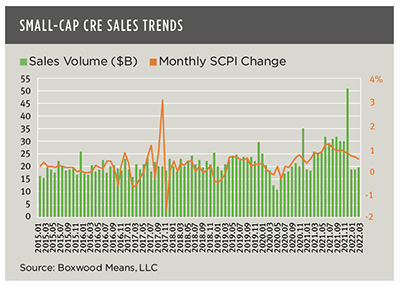

Boxwood Means LLC, Stamford, Conn., reported the robust growth in small-cap commercial real estate investments grew sluggish during the first quarter after record-breaking property sales and soaring prices last year.

Last year small-cap CRE transactions totaling $346 billion involving property trades under $5 million smashed previous records and fueled “unprecedented” annual price growth of 13.5 percent, Boxwood Means Principal and Co-Founder Randy Fuchs said. He noted 2021 growth more than doubled the pre-pandemic 5.7 percent annual return seen in 2019.

“However, facing this year’s shift to higher interest rates, growing inflationary pressures and the specter of a future recession, the buying power of small investors has waned along with some of their appetite for CRE assets,” Fuchs noted.

First quarter sales volume equaled $57 billion, on par with the corresponding quarter in 2019 but down roughly 10 percent compared with the first quarter over each of the past two years. “That said, last December was a monster month for closed sales and may very well have pulled deals forward resulting in the lower transaction totals shown in the first three months of this year,” Fuchs said.

Small-cap CRE price growth slipped to a pace below 1 percent during each of the first three months in concert with those lower sales, Fuchs said. He noted month-over-month price changes can be somewhat volatile and subject to modest future revision. Furthermore, the first quarter’s overall 2.4 percent rate of growth was equivalent to the increase during the same period from a year ago, while March’s annualized price change maintained a double-digit increase for the ninth consecutive month, he said.

“These relatively stable asset prices reflect the fact that though inflation is at a 40-year high, CRE tends to be a natural inflation hedge–as long as the economy stays the course,” Fuchs said.

Looking ahead the market could be choppy for deal-making in the near term, Fuchs said. “Some further easing in asset price growth and expectations–along with some widening of cap rates–might be a healthy development for the next stage of the market cycle and, thereby, promote improved deal flow,” he said.