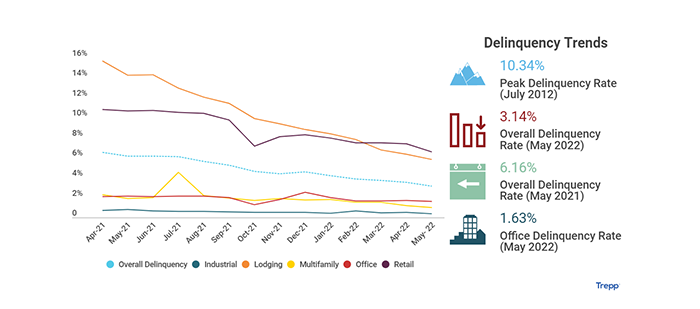

CMBS Delinquency Rate Falls Sharply

Trepp LLC, New York, said the commercial mortgage-backed securities delinquency rate posted another large decline in May.

“At the current improvement rate, the overall delinquency rate could fall below three percent in the coming months, a prospect that seemed unthinkable during the COVID-19 pandemic,” said Trepp Senior Managing Director Manus Clancy. He noted the delinquency rate’s recent peak was 10.32 percent in June 2020 amid the market volatility caused by the pandemic.

The CMBS delinquency rate fell 37 basis points in May to 3.14 percent, the biggest decline since January. “The rate has now fallen in 22 of the last 23 months with only a brief uptick in late 2021,” Clancy said.

Year-over-year, the overall U.S. CMBS delinquency rate is down 302 basis points, Trepp reported.

Trepp Research Analyst Maximillian Nelson said the CMBS special servicing rate improved in May despite wider market volatility. The special servicing rate fell 18 basis points in May to 5.12 percent. The rate equaled 8.65 percent a year ago.

Nelson noted the lodging sector experienced the largest cure, amounting to a 56-basis point drop.

“Distress rates continue to decline despite the recent volatility in the stock market, painting the picture of a CMBS market that has yet to take any collateral damage,” Nelson said. “Loans continue to cure and the market is showing a sign of resiliency–cementing itself as a different financial environment than the one we saw during the Great Financial Crisis.”

Trepp reported just more than $772 million in CMBS debt transferred to a special servicer in May and 99 percent of the new transfers came from the office, retail and mixed-use sectors.

Looking at CMBS loss severities, Moodys, New York, said CMBS liquidation volume remained low in the first quarter with loss severity essentially unchanged at 39 loans liquidated with a $658.1 million total disposition balance. Moodys said the liquidated loans had a 50 percent weighted-average loss severity, also essentially unchanged from the previous quarter. The 2014 vintage represented largest loss contributor, accounting for more than a quarter of total losses during the quarter, followed by the 2007 and 2011 vintages.

“Hotel and retail made up the majority of liquidations from defaults after the coronavirus outbreak,” Moodys said, noting 16 liquidations from defaults that occurred after the coronavirus outbreak. Hotel and retail accounted for 73 percent and 20 percent by count, respectively, of the liquidations in the first quarter from term defaults after the coronavirus outbreak.