Analysts Upgrade Hotel Forecast

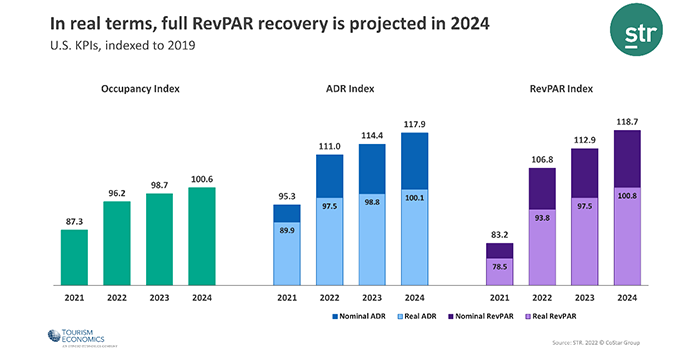

STR and Tourism Economics upgraded their recovery timeline for U.S. hotel revenue per available room.

The data firms now forecast the revenue metric will surpass 2019 levels later this year. When the COVID pandemic struck in 2020, they had forecast RevPAR would not fully bounce back until 2024.

“Demand and occupancy have trended well in line with our recent forecasts, but pricing continues to exceed expectations due to the influence of inflation as well as the economic fundamentals supporting increased guest spending,” said STR President Amanda Hite.

Hite said the major factor that sped up the timeline was an $11 increase in 2022 average daily room rates. STR and TE still expect annual hotel occupancy to come in under the pre-pandemic comparable, but forecasts ADR and RevPAR will be $14 and $6 higher than 2019, respectively.

Importantly, when adjusted for inflation, STR and TE do not project full ADR and RevPAR recovery until 2024. Central business districts and top 25 markets are not expected to reach full RevPAR recovery until after 2024.

Hite noted the latest forecast acknowledges the risk of a light recession with no anticipation of mass layoffs and household finances in a strong position to mitigate recession impacts. “The traveling public is less affected by recession, and right now, we are forecasting demand to reach historic levels in 2023 as business travel recovery has ramped up and joined the incredible demand from the leisure sector,” she said. “Of course, while the top-line metrics are set to reach full recovery on a nominal basis, we must recognize that profitability has only started hitting 2019 levels recently. Concerns persist around the cost of labor and services, and hotels in some major markets are still well behind in the recovery timeline.”

Aran Ryan, Director of Lodging Analytics with Tourism Economics, said the outlook for hotel performance remains positive. “Even as the economy faces headwinds of higher interest rates, volatile financial markets and inflation, lodging demand and room rates are being buoyed by strong household finances and the return of business travel,” he said.