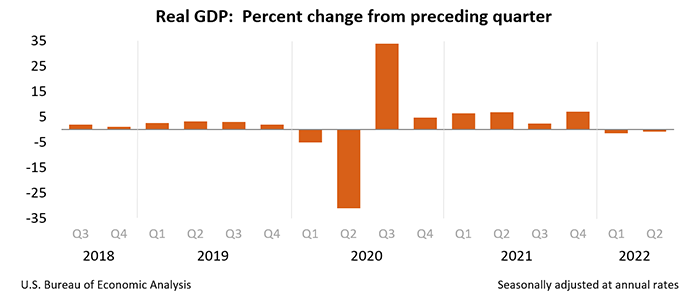

Gross Domestic Product Contracts at 0.9% Pace

Real gross domestic product decreased at an annual rate of 0.9 percent in the second quarter–the second consecutive quarter with a decline–the Bureau of Economic Analysis said Thursday.

Real GDP decreased at a 1.6 percent annual rate (revised) in the first quarter, the BEA noted. “The smaller decrease in the second quarter primarily reflected an upturn in exports and a smaller decrease in federal government spending,” the BEA said.

MBA Senior Vice President and Chief Economist Mike Fratantoni noted the headline of a second straight decline in real GDP highlights the abrupt change in the U.S. economy’s path, “but the ongoing strength in the job market and other signs of growth make it unlikely that this will be categorized as a recession at this point,” he said.

Fratantoni cited some notable trends in the GDP advance report. “First, consumer spending on goods is growing more slowly, and consumer spending on services is picking up,” he said. “This is an ongoing normalization as the effects from the pandemic wane. The travel and hospitality industries are certainly seeing a rebound.”

Second–in yet another signal that the spike in rates brought the housing market to a sudden halt–residential investment dropped at a 14% rate last quarter, contributing -0.7% to the decline in GDP, Fratantoni said. “Housing tends to lead the rest of the economy, and we expect that pattern will hold this cycle as well,” he said.

“Finally, as was the case in the first quarter, there are some anomalous factors that brought the headline number down,” Fratantoni said. “A contraction in inventories contributed 2% to the decline in overall GDP. Absent that drop, which likely reflects ongoing challenges with supply chains, headline growth would have been positive. Furthermore, government spending has declined for three successive quarters – evidence of the lapse in pandemic support measures.”

Fratantoni noted MBA is forecasting 0.6% GDP growth for all of 2022 and 1.5% growth for the next two years, with downside risk as the full impact of the Fed’s rapid rate hikes is realized over the next 12 months.