MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

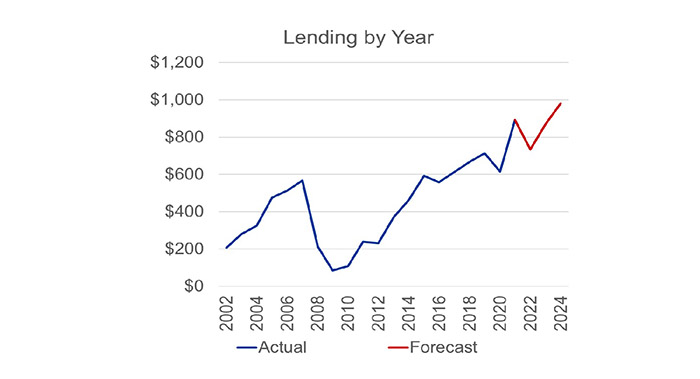

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

Multifamily lending alone (which is included in the total figures) is expected to drop to $436 billion in 2022–a 10 percent decline from last year’s record $487 billion. MBA said it anticipates borrowing and lending will rebound next year to $872 billion in total commercial real estate lending and $454 billion in multifamily lending.

“The rapid changes taking place across space, equity and debt markets are having a significant effect on commercial and multifamily real estate transaction volumes,” said Jamie Woodwell, MBA Vice President for Commercial Real Estate Research. “After a record start to the year, we expect that the rise in rates, ongoing uncertainty about supply and demand balances among some property types and concerns about the direction of the economy will suppress new loan originations in the second half of the year.”

Woodwell noted most commercial real estate market fundamentals remain strong, with significant increases in the incomes and values of many properties in recent years. “These factors are why MBA expects loan demand to begin to bounce back in 2023 and 2024,” he said.

The direction of the economy remains uncertain, but that will be a major driver of the magnitude and timing of market changes, Woodwell said. “Should the economy enter a recession, which–if it were to happen–would most likely come in the first half of 2023, commercial and multifamily borrowing and lending would likely be further constrained,” he noted.

For additional commentary on the pandemic’s impact on the sector, visit MBA’s Commercial/Multifamily Market Intelligence Blog.

MBA’s commercial/multifamily members can download a copy of MBA’s latest Commercial/Multifamily Real Estate Finance Forecast at www.mba.org/crefresearch.