CBRE: Record Global CRE Investment in 2021

CBRE, Dallas, reported global commercial real estate investment reached a record $1.3 trillion last year, up 55 percent from 2020 and 21 percent from 2019.

Volume surpassed 2019 levels in all three regions–the Americas, Europe-Middle East-Africa and Asia-Pacific–CBRE said in its latest Global Investment Brief. The Americas and EMEA regions saw record volume.

CBRE Global Chief Economist Richard Barkham said he expects another year of investment growth in 2022, “albeit at a more moderate pace than in 2021,” he said. “Continued economic growth and low interest rates will fuel investment activity.”

CBRE forecasts annual global investment volume to increase by nearly 8 percent this year, though the report cautioned that headwinds, including rising inflation, geopolitical tensions and the potential for a COVID-19 resurgence, could slow CRE investment.

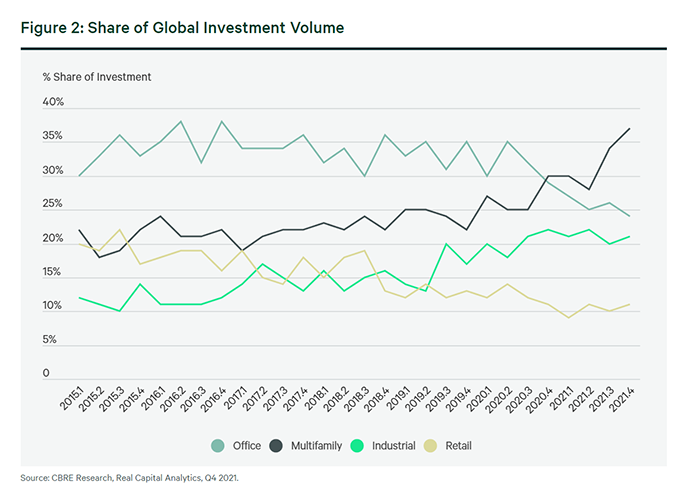

The Americas region had a “banner year” in 2021 as annual investment volume surged 86 percent to nearly $776 billion, the report said. The fourth quarter saw a record $305 billion in volume, up 90 percent from late 2020. A 116 percent growth in multifamily investment volume helped fuel the increase. “Sun Belt markets continued to see robust growth, while gateway markets began to recover–particularly in high-quality office assets,” CBRE said.

The multifamily sector’s share of total investment grew to 45 percent in late 2021, up from 41 percent in the third quarter and well above the 28 percent average seen between 2015 and 2019.

The industrial sector accounted for 22 percent of total investment volume in the quarter, on par with growth in the previous two quarters but down from its pandemic-era high of 27 percent in fourth-quarter 2020, CBRE said. Industrial investment increased 55 percent year-over-year to $64 billion in late 2021 and full-year investment in the sector increased more than 50 percent year-over-year to $160 billion.

The retail sector accounted for 11 percent of total investment volume in the fourth quarter, its highest share since second-quarter 2020, CBRE said. Retail investment more than doubled year-over-year to $34 billion in the fourth quarter and increased 84 percent for the full year to $74 billion.

“Strong entity-level activity totaling $14 billion in the second half of 2021 included Realty Income Corp.’s acquisition of VEREIT’s retail portfolio and two mergers: Kite Realty Group and Retail Properties of America and Kimco Realty and Weingarten Realty,” the report noted.

Though the office sector’s share of total investment fell to 17 percent in the fourth quarter, it recorded its highest quarterly volume since 2018 with $120 billion up 73 percent from a year before. Full-year office investment volume increased 55 percent from 2020 to $136 billion, just shy of 2019’s total.

Hotel investment volume surged more than 140 percent year-over-year in the fourth quarter to $12 billion. Full-year volume reached $43 billion, up 238 percent from pandemic-hobbled 2020. “Both were the largest percentage increases among the major property sectors as activity bounced back from COVID-suppressed levels in 2020,” the report said. Hotel investment volume increased by 11 percent in 2021 compared with its pre-pandemic performance in 2018.