MBA: 4Q Commercial/Multifamily Borrowing Up Record 79%

SAN DIEGO — The Mortgage Bankers Association said commercial and multifamily mortgage loan originations jumped by a record 79 percent in the fourth quarter from a year ago, and by 44 percent from the third quarter.

MBA Forecast: 2022 Commercial/Multifamily Lending to Hit Record $1 Trillion

SAN DIEGO — Total commercial and multifamily mortgage borrowing and lending is expected to break $1 trillion for the first time in 2022, the Mortgage Bankers Association reported Monday at its 2022 Commercial/Multifamily Finance Convention and Expo.

MBA: 2022 Commercial/Multifamily Mortgage Maturity Volumes to Increase 12 Percent

SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

Wells Fargo Leads MBA 2021 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO — The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31.

MBA Presents JLL with 2022 Commercial/Multifamily Diversity, Equity & Inclusion Leadership Award

SAN DIEGO—The Mortgage Bankers Association honored JLL with its 2022 Commercial/Multifamily Diversity, Equity and Inclusion Leadership Award.

‘Rise and Thrive:’ Bob Broeksmit, CMB, Opens CREF22

SAN DIEGO—Mortgage Bankers Association President & CEO Bob Broeksmit CMB, opened the MBA 2022 Commercial/Multifamily Finance Convention and Expo with a welcome back—it was the first live CREF Convention since 2020—and a call to action.

CREF Policy Update Feb. 17, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

How Low-Density Multifamily Could Increase Affordable Housing Supply

Enterprise Community Partners, Columbia, Md., said re-zoning land to allow low-density multifamily housing could help communities address the negative impacts of exclusionary single-family zoning.

FHFA Seeks Input on FY2022-2026 Strategic Plan

The Federal Housing Finance Agency asked for input on its Draft Strategic Plan, which outlines the Agency's priorities for the coming years as regulator of the Federal Home Loan Bank System and as regulator and conservator of Fannie Mae and Freddie Mac.

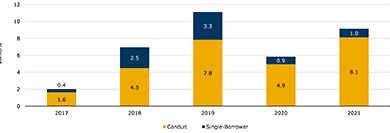

CMBS Defeasance Snaps Back

Kroll Bond Rating Agency, New York, reported commercial mortgage-backed securities defeasance volume rebounded strongly last year after falling by nearly half in 2020.