Trepp: Life Insurance Returns on Pace for Worst Performance to Date

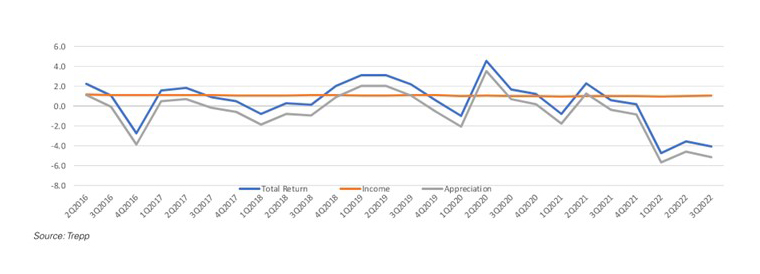

Trepp, New York, released its third quarter returns report for its life insurance commercial mortgage index, reporting the 2022 year-to-date return is predicted to be the lowest since Trepp started collecting LifeComps data in 1996.

The return has been negative for three quarters in a row, pointing towards a steep negative annual outcome. The decreasing return is attributed to rising treasury rates.

“Despite the continued negative return, there are signs that the market will persevere in the near future,” said Benqing Shen, Director of Product Management with Trepp. “November CPI data presented a lower-than-expected inflation print and the treasury market reacted by staging a rally. The 5-year treasury dropped from a high of 4.39 to 3.83 as of November 17. There are expectations of a ‘Fed pivot’ on the horizon.”

The LifeComps portfolio saw a 28% decrease quarter-over-quarter in volume of new loans funded, a 29% decrease year-over-year. “It was no surprise to see a depressed level of loan origination since the average coupon on mortgage loans rose to 4.82%, which is higher than the pre-pandemic level,” the report said.