FHFA Issues Final Rule on 2023-2024 Multifamily Housing Goals

(Courtesy Federal Housing Finance Agency)

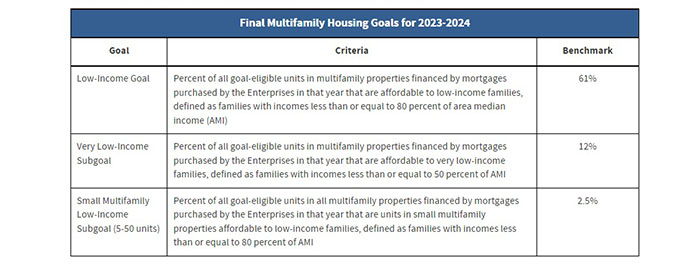

The Federal Housing Finance Agency on Wednesday issued its final rule for Fannie Mae and Freddie Mac that establishes the benchmark levels for their 2023 and 2024 multifamily housing goals.

FHFA’s final rule mostly mirrors its proposed rule issued in August, with a new percentage-based methodology for the next two years based on the percentage of affordable units in multifamily properties financed by mortgages purchased by the GSEs each year.

FHFA Director Sandra L. Thompson noted the multifamily housing goals are one method FHFA employs to ensure the enterprises remain focused on affordable segments of the market. “The new methodology will make the multifamily housing goals more responsive to market conditions and better position the enterprises to fulfill their affordable housing mission requirements each year,” she said.

The existing housing goals regulation through the end of 2022 was based on the total number of affordable units in multifamily properties. Relying, in part, on the data and forecasts of MBA, FHFA took into consideration various economic factors to determine the housing goals for the next two years.

- Why it matters: The change in methodology to a percentage-based approach is an important step towards overall simplification of the housing goals, an outcome for which MBA has advocated throughout 2022.

- What’s next: MBA’s analysis of the 2023-2024 Multifamily Housing Goals can be found here.

For more information, contact MBA’s Stephanie Milner at 202-557-2747.