CBRE: Commercial Real Estate Lending Eases

CBRE, Dallas, said commercial real estate lending activity is easing amid heightened market volatility from rising inflation and interest rates.

“Market volatility from rising inflation and interest rates cooled the commercial mortgage market in the second quarter, characterized by wider spreads and more selective underwriting,” said Rachel Vinson, President of Debt & Structured Finance, U.S. for Capital Markets at CBRE.

Vinson noted she expects debt capital to be constrained for the rest of the year as lenders determine how and where to deploy capital. “In a tight lending environment, relationships with borrowers and capital sources become all the more imperative,” she said.

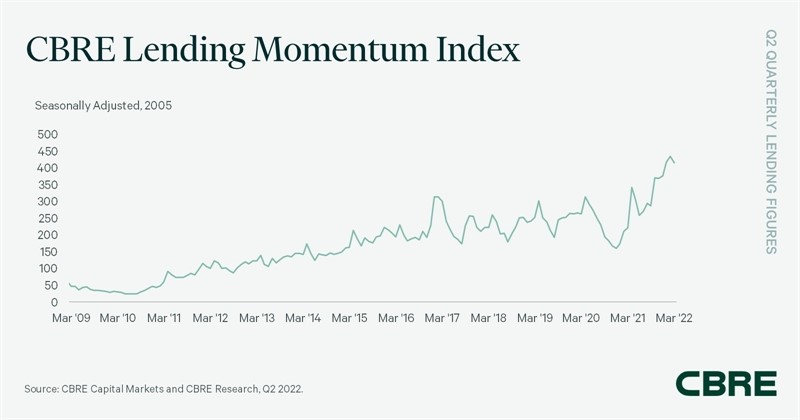

The CBRE Lending Momentum Index declined by 7.9% quarter-over-quarter, but it remains up 41.1 % year-over-year.

Banks had the largest share of non-agency loan closings in the quarter at 38.1%–up from 27.5% in Q1 2022 and 10 percentage points higher than a year ago–CBRE reported. “Banks funded a broad mix of permanent, bridge and construction loans across property types in Q2 2022,” the report said.

Alternative lenders such as debt funds and mortgage real estate investment trusts were the second-most active lending group in the quarter with 32.2% of loan closings, down from 42.7% a year ago, as bridge lending slowed. Rising spreads slowed Collateralized Loan Obligations issuance to $12.3 billion in the quarter from $15.2 billion in the previous quarter. “Multifamily has been a preferred property type for CLO issuers, as office, retail and hotel bridge lending eased,” CBRE said.

Life companies accounted for 26.2% of closed non-agency loans in the quarter, on par with their first-quarter share and more than double their 10.5% share from a year earlier. Most originations were permanent fixed-rate loans to a mix of property types with a 57% average loan-to-value ratio.

Commercial mortgage-backed securities conduit loans accounted for the remaining 3.5% of non-agency loan volume in the quarter, down from 16.5% a year ago. “CMBS origination volume stalled in June amid rising spreads and market volatility,” CBRE said.

Loan underwriting criteria grew more conservative in the second quarter, the report noted. Average loan-to-value ratios fell while underwritten cap rates and debt yields increased. The percentage of loans carrying interest-only terms decreased to 58.8% from 68.3% in early 2022.

Government agency lending of multifamily assets totaled $33.4 billion in the second quarter, up 39.2% from a year ago. Fannie Mae and Freddie Mac have a combined $156 million purchase cap this year, half of which is targeted to affordable and underserved markets.

CBRE said its Agency Pricing Index, which reflects the average agency fixed mortgage rates for closed permanent loans with a seven- to 10-year term, increased by 39 basis points in the second quarter and 59 basis points from a year ago to average 3.87%.