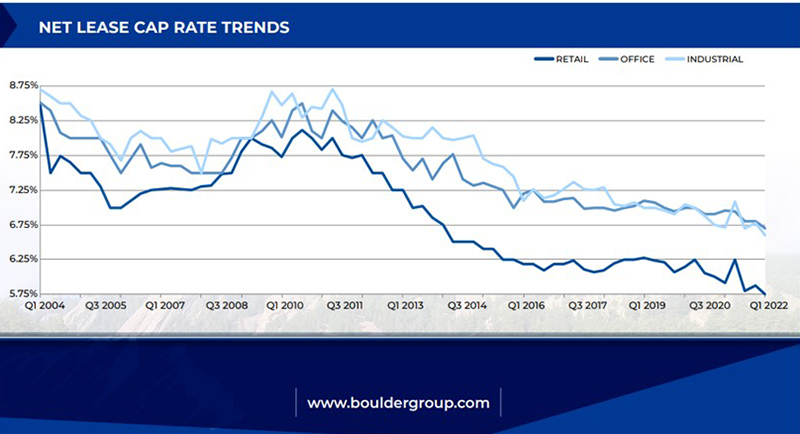

1Q Cap Rates Reach Historic Lows

MBA NewsLink Staff

Cap rates in the single-tenant net lease sector reached historic lows for all three asset classes in the first quarter, said Boulder Group, Northbrook, Ill.

The company’s first quarter Net Lease Market Report said single-tenant cap rates compressed by 13, 10 and 17 basis points for the retail, office and industrial categories respectively. Following record transaction volume in 2021, net lease sales velocity continued in the first quarter: transaction volume in the first quarter exceeded first quarter 2021 by more than 10% for the net lease sector.

Boulder Group said cap rate compression continues to be derived from “significant demand for net lease properties across all investor classes.”

Despite the record 2021 transaction volume, the report said overall net lease property supply declined by more than 5% in the first quarter. Boulder Group cited supply chain issues and delayed expansion plans for retailers related to Covid-19 as limiting new construction supply. Only 15% of net lease retail properties on the market were constructed in 2021 or 2022. Accordingly, new construction properties with credit tenants including AutoZone, CVS and Dollar General experienced greater compression. Cap rates for these tenants compressed by 20, 15 and 10 basis points respectively, in the first quarter.

The report noted competition among investors for high quality net lease product can be evidenced by the bid-ask spread in the first quarter. The spread between asking and closed cap rates compressed by 2, 5 and 7 basis points respectively for retail, office and industrial sectors.

The report also noted towards the end of the first quarter, interest rates and inflation posed concerns to investors. “The 10-Year Treasury Yield in the third quarter experienced a significant rise of 70 basis points and inflation has run to record levels; accordingly, net lease investors are targeting properties with fixed rental escalations during the term of their leases,” the report said

Looking ahead, Boulder Group said transaction activity in the net lease sector will remain active through 2022. “Property supply will be a constraint for transaction volume as current demand for net lease assets outpaces supply,” the report said. “Net lease investors will be carefully monitoring the capital markets following the uptick in the 10-Year Treasury towards the end of the quarter. Cap rates will face upward pressure as the Fed has forecast multiple rate hikes in 2022.”