Rising Construction Tide Lifts Office-To-Lab Conversions

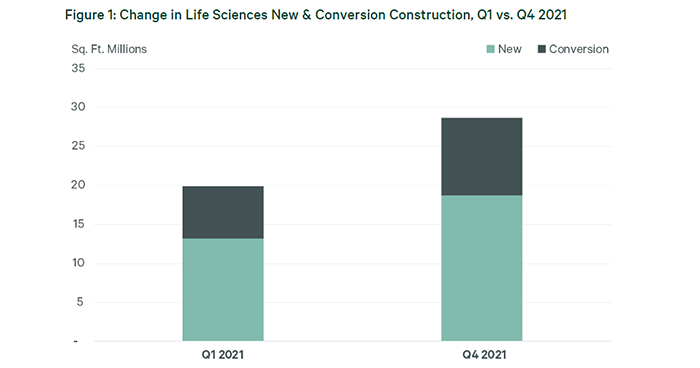

CBRE, Dallas, reported a sharp increase in construction of life sciences labs includes big gains in a premium category: conversions of office buildings to labs.

In its report, Despite the Cost, Construction of Life Sciences Properties Brings Strong Returns, CBRE said office-to-lab conversions in progress in the 12 largest U.S. life sciences markets in December totaled 9.9 million square feet, up 49 percent from January 2021. In comparison, ground-up lab construction increased 42 percent to nearly 18.8 million square feet year-end 2021.

“To be sure, both measures increased greatly,” the report said. “But the jump in conversions underscores the challenges in building enough lab space to meet demand in recent years.” Lab vacancy in many top markets sits at 4 percent or less, CBRE said.

The cost to fit out lab space with necessary plumbing, ventilation, clean rooms and other specialized considerations can be double to triple that of fitting out standard office space, the report said. But the increase in conversion activity last year indicates developers and investors are willing to cover those costs to capture the potential rent premium lab space holds over traditional office space. Lab lease rates increased by an average of 11 percent last year in the 12 largest life sciences hubs. Meanwhile, office lease rates in those markets increased just 2 percent.

“Converting an office building for life sciences use often can be done more quickly than building labs from the ground up,” said Matt Gardner, CBRE Americas Life Sciences Leader. “In addition, investors see advantages in lab rent growth and the scant vacancy rates for labs in comparison to offices.”

But Gardner noted many lab uses have extensive and significant requirements of facilities, so not every office building is a good candidate for conversion, he said.

The busiest markets for office-to-lab conversions include Boston with 3.3 million square feet underway, San Diego with 1.6 million square feet and Raleigh-Durham, N.C. with 1.1 million square feet of conversions currently.