Study: Inclusionary Housing Policies Deliver More Affordable Homes

MBA NewsLink Staff

A study by a Mortgage Bankers Association-supported member network suggests an optimal mix of incentives and requirements could help policymakers avoid polarizing private sector and community stakeholder groups while working toward the goal of increasing affordable housing production.

Up for Growth, a cross-sector member network committed to solving the housing shortage and affordability crisis through data-driven research and evidence-based policy, published an analysis of inclusionary housing policies. The first in a series of policy briefs, Missed Opportunities: Assessing and Leveraging Requirements, Incentives and Trade-Offs in Affordable Housing Development, examines how establishing set-aside and affordability pairings without careful calibration rooted in current housing market economics can create missed opportunities to both maximize the number of affordable units produced and ensure lasting affordability by adjusting offsets.

“There is common ground to be found among developers and advocates around policies that leverage tax exemptions and other offsets to increase affordable housing production and achieve lasting affordability,” said Mike Kingsella, CEO of Up for Growth. “The decision to implement an inclusionary housing policy does not have to be a binary choice. Recommendations from the report could significantly increase the total number of affordable units produced in market-rate apartments in communities with IH policies.”

Key report findings:

• Effectiveness of tax exemptions: Local jurisdictions can prioritize targeted outcomes – around the depth of affordability and the percentage of units set aside in mixed-income developments – by leveraging longer tax exemption periods.

• Maximizing number of units: Nearly 60% of Up for Growth members prioritize maximizing the number of affordable units created over deeper affordability (defined as the affordability level based on household income thresholds, typically 60 percent of 80 percent of an area’s median family income.)

• Calibrating tradeoffs: To maximize housing production and ensure long-term affordability, policymakers must carefully calibrate tradeoffs between short-term forgone property tax revenue and long-term public benefit.

“We are grateful to Up for Growth for their work examining the affordable housing crisis in this country, an issue which is a top priority for MBA and its members,” said Steve O’Connor, MBA Senior Vice President of Affordable Housing Initiatives. “We agree with the premise of the research, that we must find broadly beneficial ways to increase the supply of affordable rental housing and we look forward to working with Up for Growth and all housing stakeholders to find solutions that support both the financing and production of affordable housing.”

“Poorly crafted inclusionary zoning programs run the risk of stifling housing construction and harming housing affordability for people at all income levels,” said Emily Hamilton, senior research fellow at the Mercatus Center at George Mason University. “This analysis from Up for Growth demonstrates the importance of policymakers including offsets for below-market-rate units in their inclusionary zoning programs and provides strategies for maximizing the program’s benefits for housing affordability.”

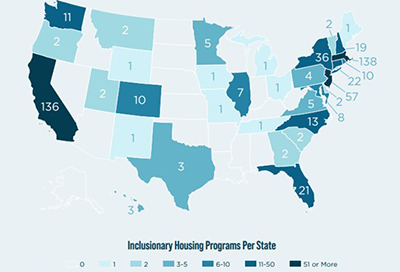

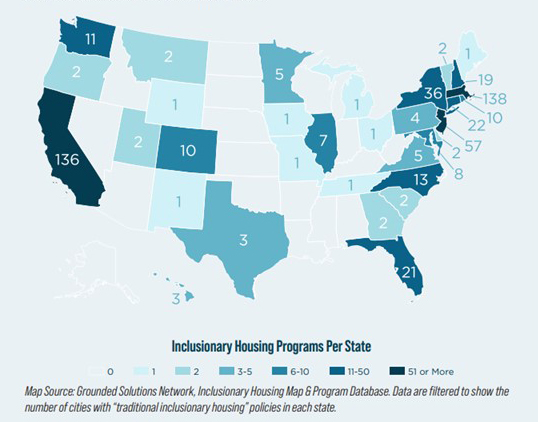

“For policymakers working to enlist private-sector partners toward the goal of increased affordable housing production with lasting affordability, determining the mix of policies and incentives and their impact on outcomes can be daunting and difficult to quantify,” said Tony Pickett, CEO of Grounded Solutions Network.