Trepp: Bank Commercial Real Estate Loan Performance ‘Not Bad, But Maybe Not That Great’

Trepp, New York, said delinquency rates for commercial real estate loans held by banks are declining after increasing modestly last year.

But Trepp’s Anonymized Loan-Level Repository data set found that individual property sectors including the hard-hit lodging and retail sectors are experiencing much higher delinquency rates due to last year’s recession.

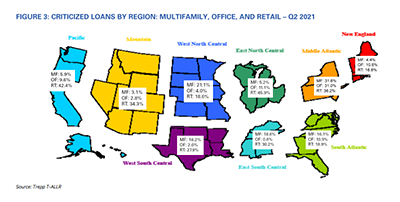

“Furthermore, banks’ risk ratings indicate regional and property type concerns that are not uniform,” said Matt Anderson, Trepp Managing Director of Applied Data and Research.

Trepp said criticized loan rates–those with a standardized risk rating of 6 or higher–showed significant variation across geographies and property types. “When the pandemic hit in the first quarter of 2020, lenders were allowed to offer forbearance to COVID-impacted borrowers,” the report said. “If a borrower received forbearance, the loan would not be marked as delinquent. However, the lender was expected to update its risk rating on the loan to reflect the lender’s expectations for ultimate re-payment of the loan. So, while delinquency rates have shown a more muted response to the economic disruption of 2020, risk ratings started to adjust immediately.”

The Trepp report called second-quarter bank CRE loan performance “not bad, but maybe not that great either.”

Jamie Woodwell, Vice President of Commercial Real Estate Research with the Mortgage Bankers Association, said commercial and multifamily mortgage performance remains highly property-type dependent, “but on the whole, the sector has come through the pandemic with relative strength,” he said.

MBA recently released two reports, the CREF Loan Performance Survey for August 2021 and the Second Quarter Commercial/Multifamily Delinquency Report.

Woodwell noted the latest FDIC data covering all their insured depositories show the non-current rates for multifamily loans rose to a pandemic-level high of 0.28 percent during second-quarter 2021, while the rate for other commercial property loans fell from a high two quarters earlier of 1.00 percent to 0.89 percent. For comparison purposes, during the Great Recession those levels hit 4.71 percent for multifamily and 4.36 percent for other property types.

Trepp studied more than $160 billion in bank balance sheet loan data sourced from multiple banks. It found bank CRE mortgage delinquencies hit a recent peak of 1.3 percent in late 2020 as the pandemic disrupted economic activity. “Since year-end 2020, the economic recovery that began in the second half of last year has helped bring mortgage delinquency rates down, with modest improvements in both Q1 and Q2 2021,” the report said.