MBA: September Commercial, Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

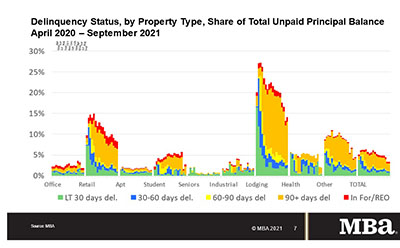

“Commercial and multifamily mortgage performance has improved considerably since the worst of the downturn,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “The stress that entered–and remains–in the market is largely concentrated in lodging and retail properties, with fewer new loans becoming delinquent and shrinking balances of overall delinquency as lenders and servicers work out the longer-term troubled loans.”

Key Findings from MBA’s CREF Loan Performance Survey for September:

The balance of commercial and multifamily mortgages that are not current decreased slightly in September.

- 96.7% of outstanding loan balances were current, up from 96.6% in August 2021.

- 2.2% were 90+ days delinquent or in REO, unchanged from a month earlier.

- 0.2% were 60-90 days delinquent, unchanged from a month earlier.

- 0.3% were 30-60 days delinquent, unchanged from a month earlier.

- 0.8% were less than 30 days delinquent, unchanged from a month earlier.

Loans backed by lodging and retail properties continue to see the greatest stress.

- 14.0% of the balance of lodging loans were delinquent, up from 13.4% a month earlier.

- 8.2% of the balance of retail loan balances were delinquent, down from 8.5% a month earlier.

- Non-current rates for other property types were at lower levels during the month.

- 1.8% of the balances of industrial property loans were non-current, up from 1.5% a month earlier.

- 1.8% of the balances of office property loans were non-current, down from 2.0% a month earlier.

- 1.3% of multifamily balances were non-current, up from 1.2% a month earlier.

Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources.

- 7.2% of CMBS loan balances were non-current, up from 6.9% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.0% of FHA multifamily and health care loan balances were non-current, unchanged from a month earlier.

- 1.2% of life company loan balances were non-current, down from 1.9% a month earlier.

- 0.6% of GSE loan balances were non-current, unchanged from a month earlier.

Click here for more information on MBA’s CREF Loan Performance Survey.