JLL: Value-Add Office Back in Favor

Chart courtesy of JLL

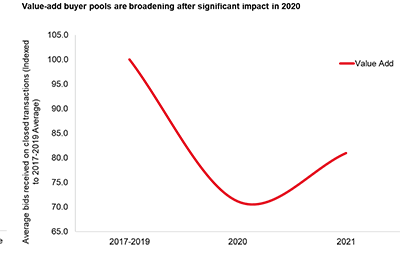

Many office investors focused on core office properties during the pandemic, but value-add liquidity is quickly recovering as clarity surrounding rent growth and the future of office demand improve, said JLL, Chicago.

“We’re seeing investors pivot back to previously out of favor sectors like office and hospitality that can produce very attractive yields,” said Coleman Benedict, Senior Managing Director and Co-Head of JLL’s National Office Practice. “As part of this rotation back to office, value-add is definitely back on investors’ radar, reinforcing the investment community’s confidence in the long-term stability of the office market.”

Benedict noted value-add office saw the most significant impact to liquidity during the pandemic due to demand uncertainty. “As a result, the share of value-add office sales declined relative to historical averages,” he said. “However, thus far in 2021, value-add is the most sought-after profile with the share of value-add office properties in the current pipeline recovered from declines in 2020, and currently recovering toward the 2017-2019 levels.”

Additionally, value-add buyer pools are broadening and have seen the most improvement in 2021 relative to 2020, Benedict said.

All signs point to a continued rebound in the capital markets for office assets, JLL said in a new report, Value-Add Office is Back in Favor. “Office will continue to gain momentum as investors look to deploy abundant dry powder,” the report said. “The office market offers favorable risk-adjusted returns and can provide a considerable yield premium versus sectors such as industrial and multifamily, which have seen record cap rate compression.”

In addition, most corporate occupiers have signaled the office will remain the center of the work ecosystem. “A physical office reinforces culture, drives collaboration and innovation, enables professional growth and brings a company’s best to its clients and employees,” the report said. “Hybrid work will have a durable presence but the net impact on space usage and footprints will be relatively minor.”