CMBS Delinquencies Tick Up; Special Servicing Rate Drops

Chart courtesy of Fitch

The commercial mortgage-backed securities delinquency rate and special servicing rate moved in opposite directions in April, two new reports said.

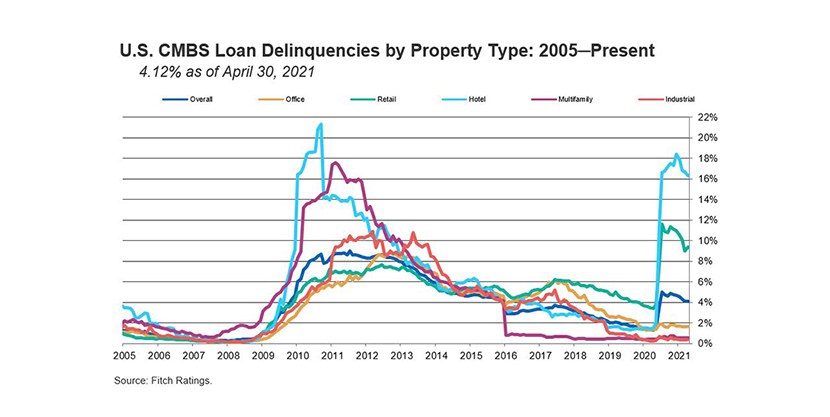

Fitch Ratings, New York, said the CMBS delinquency rate rose two basis points to 4.12 percent in April due to a “spike” in new delinquencies that was partially offset by strong new issuance volume.

“This is the first [delinquency rate] increase after five consecutive months of decline,” Fitch said in its April CMBS Market Trends report. The ratings firm said it had anticipated some delinquency rate volatility as the federal stimulus burns off and coronavirus debt relief expires.

“With the exception of hotel and industrial, all major property types reported higher delinquency rates from the prior month,” Fitch said.

In a separate report, Fitch said the CMBS cumulative default rate reached a new high 18.2 percent last year, exceeding the 16.8 percent prior peak set in 2013. Hotel and retail claimed the largest share of defaults. “The increase in the cumulative default rate was also influenced by the sharp decline in new issuance in 2020,” Fitch said.

Trepp LLC, New York, said the CMBS special servicing rate declined by 40 basis points in April to 9.02 percent, the largest improvement during the coronavirus market crisis.

The drop was the seventh monthly special servicing rate decrease since it reached a post-Great Recession peak of 10.48 percent last September. “With federal plans underway to make vaccinations more widely available in the U.S. and states taking steps to ease lockdown restrictions even further, loan ‘cures’ and special servicing removals should continue at a measurable pace in the coming months,” Trepp said.

Looking at property types, Trepp found the percentage of loans in special servicing was relatively consistent month over month except for lodging and retail loans, which registered 233- and 37-basis-point reductions in April, respectively. Nearly 22 percent of lodging loans and more than 15 percent of retail loans were reported as being in special servicing in April.

“The volume of loans exiting special servicing remains above the loan balance that has been transferred in, which has helped to put downward pressure on the overall reading,” Trepp said. Nearly $3 billion in loans left special servicing last month while about $1.1 billion was newly added to the special servicer list.