Apartment Investment Environment Remains Positive

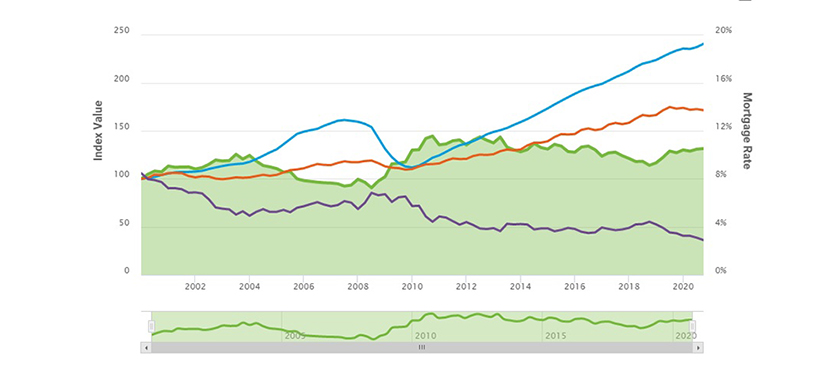

Chart courtesy of Freddie Mac

Freddie Mac, McLean, Va., said its Apartment Investment Market Index remained positive in the fourth quarter despite contractions in several major metros.

The company’s multifamily Apartment Investment Market Index rose 0.5 percent during the quarter after rebounding 1.9 percent in the third quarter. A rise in AIMI implies an increasingly favorable environment for multifamily investment opportunities. The index declined 0.3 percent in the second quarter.

The slight growth reflected a quarter where falling mortgage rates offset negative change in net operating income and property price growth, both driven in part by the COVID-19 pandemic. On an annual basis, AIMI rose by 3.4 percent as mortgage rates decreased by 57 basis points, Freddie Mac reported.

“Over the year, AIMI remained positive nationally and in most markets, but some local markets felt the impact of the pandemic more acutely and experienced substantial contractions,” said Freddie Mac Multifamily Vice President of Research and Modeling Steve Guggenmos.

Guggenmos noted the index’s fourth quarter growth “continued the trend of generally resilient multifamily fundamentals throughout the pandemic.”

Over the quarter, AIMI increased nationally and in most markets. Freddie Mac said 16 markets experienced quarterly growth while nine metros saw contraction.

–Most metros experienced a decline in NOI. The nation and 16 markets experienced quarterly NOI contraction, while nine metros experienced positive NOI growth. Just as in the third quarter, New York and San Francisco were especially pronounced, dropping –6.2 percent and -9.4 percent, respectively.

–Property price growth was also mixed, the report said. Prices grew nationally and in 14 markets while prices dropped in nine markets. Two markets, Atlanta and Philadelphia, experienced effectively no property price change.

–Mortgage rates decreased by 20 basis points.

For full-year 2020, AIMI increased in the nation and in 18 markets, while seven markets experienced an AIMI drop, the report said.

–NOI dropped in the nation and in 15 markets. New York and San Francisco posted double-digit NOI losses for the second consecutive quarter and 10 markets posted annual NOI gains, including Jacksonville and Phoenix, which each exceeded 5 percent growth.

–The nation and 16 markets experienced property price growth for the year while nine metros experienced contraction. Property prices grew by 11.2 percent in Phoenix – far higher than any other metro.

–Mortgage rates decreased by 57 basis points, a bigger drop than the quarter before, but not as extreme as each of the prior four quarters.