‘Quick Start’ for 2021 Single-Family Rent Growth

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.8 percent year-over-year in January, up from a 2.9 percent annual increase a year ago.

The firm’s Single-Family Rent Index report said January represented a “quick start” for the sector.

CoreLogic Principal Economist Molly Boesel noted some prospective home buyers are being priced out of the housing market as home prices continue to rise, keeping many households as renters. “This demand for rentals will push down single-family rental vacancy rates and put further upward pressure on rent growth this year, especially as the economy continues to recover,” she said.

In February, CoreLogic found 48 percent of non-homeowners who were not able to find a home to buy in their price range and desired location said they would continue to rent.

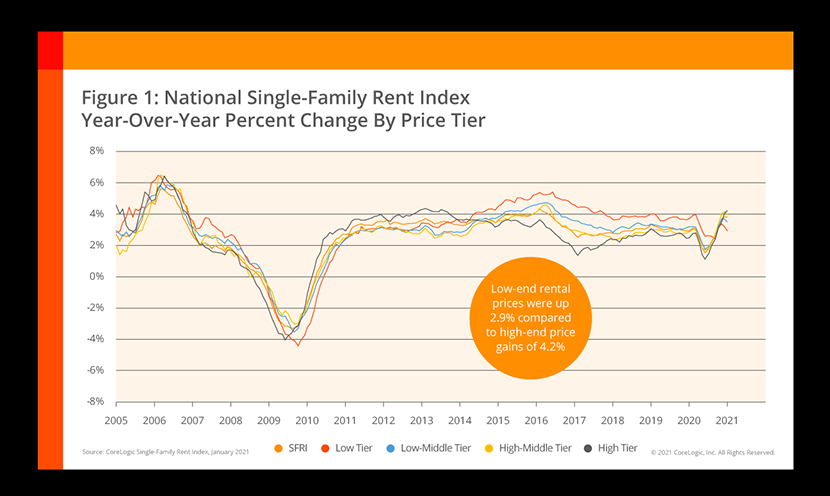

SFR rent growth showed “promising strength” in January, CoreLogic said. National rent prices reached the largest annual gain since June 2016 and prices in three of CoreLogic’s four price tiers exceeded pre-pandemic levels:

–Lower-priced SFR properties (75 percent or less than the regional median): 2.9 percent, down from 3.7 percent in January 2020.

–Lower-middle priced (75 percent to 100 percent of the regional median): 3.5 percent, up from 3.2 percent in January 2020.

–Higher-middle priced (100 percent to 125 percent of the regional median): 4 percent, up from 2.8 percent in January 2020.

–Higher-priced (125 percent or more than the regional median): 4.2 percent, up from 2.5 percent a year before.

Arbor, Uniondale, N.Y., said the single-family rental sector entered the pandemic riding a wave of momentum. “Since the onset of the pandemic, domestic migration patterns and shifts in housing demand have unilaterally added fuel to the SFR fire,” Arbor said in its Fourth Quarter Single-Family Rental Investment Trends report. “The millennial cohort’s maturation, coupled with the obsolescence of cities during a pandemic, has meaningfully bumped up demand for suburban housing.”

The Census Bureau found occupancy rates across all single-family rentals averaged 95.1 percent in the fourth quarter, 20 basis points tighter than in the third quarter. “The latest estimate keeps [SFR] occupancy levels near generational highs last seen in 1994,” Arbor said.

Among the 20 largest metro areas, and for the twenty-sixth consecutive month, Phoenix saw the highest year-over-year increase in single-family rents in January at 11 percent. Tucson, Ariz., had the second-highest rent price growth with a 9.8 percent gain, followed by Charlotte, N.C. at 7.6 percent.

Conversely, Boston saw an 8.6 percent annual decline in rent prices. The city has experienced the largest decrease in all analyzed metros’ rent prices for six consecutive months.