Single-Family Rent Growth Exceeds Pre-Pandemic Rates

Chart courtesy of CoreLogic

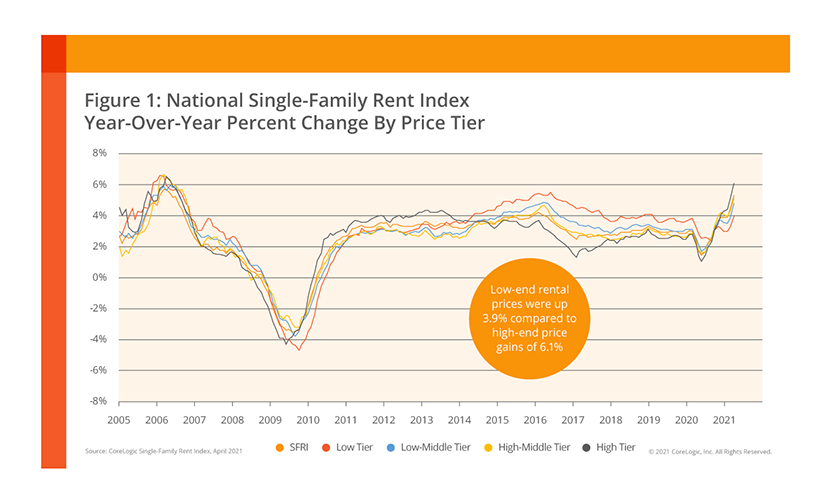

Rent growth in single-family rental properties now exceeds pre-pandemic rates across all price tiers, including low-end rentals for the first time, reported CoreLogic, Irvine, Calif.

“Single-family rent growth showed a strong rebound in April 2021 with all price tiers back above their pre-pandemic rent growth rate,” said Molly Boesel, Principal Economist with CoreLogic. “While rent growth slowed last April at the start of the pandemic, the rate of rent growth this April was running above pre-pandemic levels even when compared with 2019 and shows no signs of diminishing.”

The CoreLogic Single-Family Rent Index showed a 5.3 percent national rent increase year-over-year, up from a 2.4 percent year-over-year increase in April 2020.

In a new report, Multifamily and Single-Family Rentals to Continue Outpacing the Rest of the U.S. Housing Market, DBRS Morningstar said high consumer debt burdens and wage levels that lag cost-of-living increases make it difficult for many potential homebuyers to afford a house, which drives them toward single-family and multifamily rentals.

“Single-family rental may be the new first home because of lack of affordability that is attributable to low supply of single-family homes [available for purchase], particularly in the lower-tier price points,” said Adler Salomon, Senior Vice President with DBRS.

DBRS said nationwide vacancy for all rental units dropped to a 20-year low of 6.4 percent in 2020, down from 10.8 percent in 2009, even though single-family rental and multifamily rental inventory rose faster than overall U.S. housing inventory during that time.

A recent CoreLogic survey found 49 percent of Millennials and 64 percent of Baby Boomers “strongly prefer” to live in a single, stand-alone home. “In response, developers are turning to options like build-to-rent communities of luxury single-family rentals that appeal to Baby Boomers looking to downsize and Millennials seeking more space without sacrificing needed flexibility as companies determine remote work policies,” the report said.

CoreLogic groups SFR properties into four rent-price tiers. On a year-over-year basis, single-family rent growth for lower-priced assets (75 percent or less of the regional median) were up 3.9 percent in April while rents for properties priced between 75 percent and 100 percent of the median increased 4.8 percent, properties priced between 100 and 125 percent of the median increased 5.1 percent and higher-priced assets above 125 percent of the median jumped 6.1 percent.