MBA Chart of the Week June 14, 2021: Key Tax Proposals for Commercial Real Estate Finance

The Biden Administration’s proposed Fiscal Year 2022 Budget put down in black and white – and dollars and cents – many suggestions that have been made in more general terms in the Administration’s American Jobs and Family Plan, during the most recent presidential campaigns and in some cases going back decades.

While the overall budget lays out a host of important programmatic and spending priorities, tax items that some might consider “pay-fors” for the proposed infrastructure spending have drawn the most attention in commercial real estate circles.

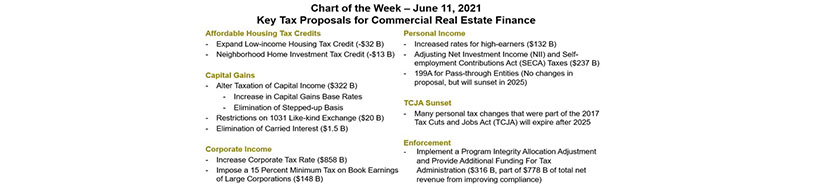

Key tax elements of the proposal related to commercial real estate are highlighted in the chart above, along with the Office of Management and Budget’s estimates of the 10-year impact on government revenues for each item (in parenthesis). As can be seen, if enacted, a wide range of proposals could affect the after-tax returns of investing in commercial real estate, and in some cases, significantly.

Of course, MBA’s Legislative and Political Affairs team is quick to remind us that budget proposals are the very first part of a complex set of conversations, the results of which often differ significantly from the opening salvo. For example, this recent CNBC article, “Bipartisan groups will work on infrastructure — the hard part is paying for it.”

President Biden’s tax proposals include a dollop of good news for commercial real estate markets, including expanding the Low-Income Housing Tax Credit by $32 billion. That incentive to put capital to work, however, is more than countered by a range of proposals that would increase taxes on investments in real estate. Capital gains would be taxed more heavily, including elements that would raise the tax rate, eliminate the stepped-up basis, and restrict the use of 1031 like-kind exchanges. For many individuals, income received from real estate investments would also be taxed more heavily – both through changes to the rates and tax brackets applied to higher-income individuals, and through the eventual sunsetting of individual tax provisions from 2017’s Tax Cuts and Job Act (TCJA).

The Biden administration’s fiscal year 2022 budget proposal is just one of many views of how the U.S. tax structure should work. For those in commercial real estate, the issues are real, the stakes are high, and what comes out the other end of this negotiation process (if anything) could have significant implications.

–Jamie Woodwell jwoodwell@mba.org.