MBA: C/MF Mortgage Delinquencies Decline to Lowest Level Since Pandemic

Delinquency rates for mortgages backed by commercial and multifamily properties continue to decline, according to two reports by the Mortgage Bankers Association.

The findings come from MBA’s Commercial Real Estate Finance Loan Performance Survey for May and the latest quarterly Commercial/Multifamily Delinquency Report for the first quarter.

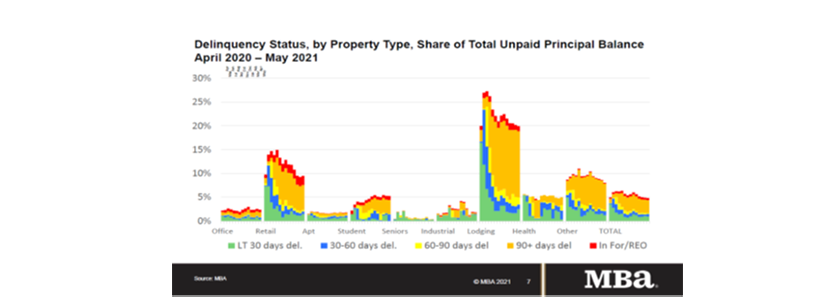

“Commercial and multifamily mortgage delinquency rates ticked down last month to the lowest level since the onset of the COVID-19 pandemic,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “Pockets of elevated stress remain in loans backed by lodging and retail properties, driven by loans in the later-stages of delinquency and foreclosure or REO. Quarterly measures of delinquency rates between last year’s fourth quarter and this year’s first quarter show a drop in distress across nearly every capital source.”

Key Findings from MBA’s CREF Loan Performance Survey for May:

The balance of commercial and multifamily mortgages that are not current decreased again in May to its lowest level since the onset of the pandemic.

• 95.2 percent of outstanding loan balances were current, up from 95.1 percent in April.

• 3.1 percent were 90+ days delinquent or in REO, down from 3.2 percent a month earlier.

• 0.2 percent were 60-90 days delinquent, down from 0.3 percent a month earlier.

• 0.5 percent were 30-60 days delinquent, up from 0.4 percent a month earlier.

• 1.0 percent were less than 30 days delinquent, down from 1.1 percent.

Loans backed by lodging and retail properties continue to see the greatest stress.

• 20.0 percent of the balance of lodging loans were delinquent, down from 20.2 percent a month earlier.

• 9.5 percent of the balance of retail loan balances were delinquent, up from 9.3 percent a month earlier.

• Non-current rates for other property types were at lower levels during the month.

• 1.9 percent of the balances of industrial property loans were non-current, unchanged from a month earlier.

• 2.4 percent of the balances of office property loans were non-current, down from 2.6 percent a month earlier.

• 1.8 percent of multifamily balances were non-current, up from 1.7 percent a month earlier.

Because of the concentration of hotel and retail loans, commercial mortgage-backed securities loan delinquency rates are higher than other capital sources.

• 8.2 percent of CMBS loan balances were non-current, down from 8.5 percent a month earlier.

• Non-current rates for other capital sources were more moderate.

• 2.4 percent of FHA multifamily and health care loan balances were non-current, up from 2.1 percent a month earlier.

• 2.0 percent of life company loan balances were non-current, unchanged from a month earlier.

• 1.2 percent of GSE loan balances were non-current, up from 1.1 percent a month earlier.

Click here for more information on MBA’s May CREF Loan Performance Survey.

Note: The survey includes a range of delinquency measures, but for the purposes of understanding the impacts from the pandemic, any non-current loan is generally treated as delinquent).

Key Findings from MBA’s First Quarter Commercial/Multifamily Delinquency Report:

• Commercial and multifamily mortgage delinquencies decreased in the first quarter of 2021.

o Banks and thrifts (90 or more days delinquent or in non-accrual): 0.80 percent, a decrease of 0.03 percentage points from the fourth quarter of 2020;

o Life company portfolios (60 or more days delinquent): 0.10 percent, a decrease of 0.06 from the fourth quarter;

o Fannie Mae (60 or more days delinquent): 0.66 percent, a decrease of 0.32 percentage points from the fourth quarter;

o Freddie Mac (60 or more days delinquent): 0.17 percent, an increase of 0.01 from the fourth quarter; and

o CMBS (30 or more days delinquent or in REO): 6.30 percent, a decrease of 1.20 percentage points from the fourth quarter.

MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another.

Note: MBA’s quarterly report relies on the headline delinquency measures used by each capital source. Each capital source’s measure is different. The different measures can give a good indication of delinquency trends within a source but should not be used to compare any one capital source to another.

Differences between the delinquencies measures are detailed in Appendix A. Visit https://www.mba.org/Documents/Research/1Q21CMFDelinquency.pdf to view the report.