Global CRE Investment Could Surge in Second-Half 2021

Illustration courtesy of Colliers International

Investors are largely optimistic about a commercial real estate market rebound later this year, said Colliers International, Toronto.

Colliers said it anticipates an up to 50 percent year-over-year surge in investment activity in the second half of 2021, citing a broad-based renewal of confidence in the property market due to recent vaccine developments and continued government stimulus.

“Longer-term tailwinds in the property sector remain intact,” said Colliers Head of Capital Markets Tony Horrell. “With a massive volume of equity raised globally and the need for real assets, investors are eager to deploy pent-up capital and pursue opportunities during the year.”

Horrell said he expects to see investors move up the risk curve this year, “with investors exploring all types of assets from senior care homes to public infrastructure projects.”

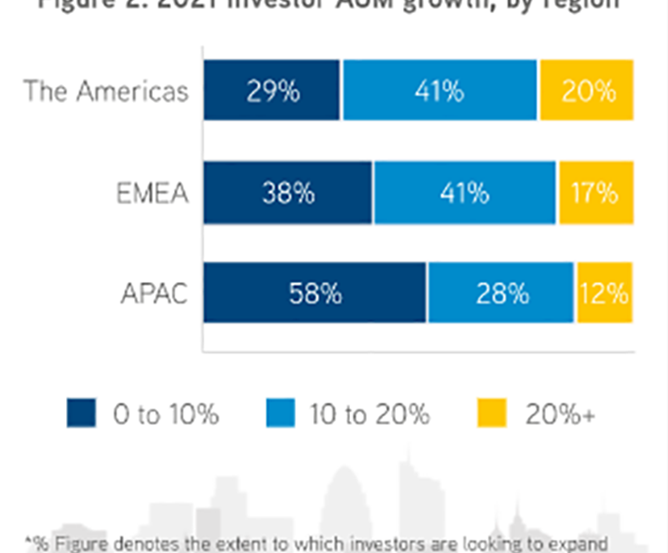

Colliers’ Global Capital Markets report surveyed nearly 300 respondents including major institutional investors, listed property companies, sovereign wealth funds, private equity funds, family offices and third-party money managers. It found investors across all regions plan to expand their portfolios, with more than half looking to looking to expand their portfolio by more than 10 percent.

Additional takeaways from the report include:

–Top-tier city offices remain a primary asset target. Investors with international capital find the scale and liquidity of the office sector in major commercial hubs such as New York, London and Sydney appealing. Having office assets that meet health, sustainability and technical benchmarks is important to investors.

–Industrial and multifamily sectors are thriving. Both sectors were among investors’ top three choices across all regions. Intense demand for these assets will require investors to broaden their geographic focus and build portfolios through joint venture platforms and local partnerships, the report said.

–Opportunities to repurpose “discounted” retail and hospitality assets. Investors said they expect to see pricing discounts of 20 percent or more in these sectors this year. “They represent a rare opportunity to acquire core and distressed assets for ambitious repurposing initiatives,” Colliers said.

–Alternatives, platforms and partnerships play a bigger part. Rising demand for alternative assets such as data centers, senior living and life science assets reflects structural shifts amplified by the pandemic.