RIHA: More Renters, Fewer Homeowners Missed Housing Payments in September, October

Renters were three times more likely than homeowners to miss payments during September and October, according to updated research released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

The RIHA study, Housing-Related Financial Distress During the Pandemic, found the share of renters who missed, delayed or made a reduced payment increased from 8.6% in July to 9.6% in September and 10.9% in October. Fewer homeowners missed payments in September (3.2%) compared to June and July (4.6% and 3.8%, respectively), but the share did rise in October (3.8%).

“The economy and labor market continued to improve during the fall months, but the sunset of government support programs, inflationary pressures and rising COVID-19 cases were all likely factors in the upticks in missed housing payments in September and October,” said Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University. “Renters were three times as likely to miss a housing payment compared to homeowners and appeared to be vulnerable to the expiration of expanded pandemic unemployment benefits. The share of renters who received unemployment fell from 6% over the summer to below 1% in October.”

Since onset of the pandemic in second quarter 2020, missed rental payments through October are estimated to be $52.5 billion, and missed mortgage payments total $83.9 billion.

“RIHA’s research throughout the pandemic has provided a comprehensive picture for industry stakeholders and policymakers on households’ ability to make their housing statements,” said Edward Seiler, RIHA Executive Director and MBA Associate Vice President of Housing Economics. “The overall economic outlook looks brighter but still greatly depends on the course of the virus. Continued job growth and wage gains – especially if they can offset inflation – are key to helping those households that are still facing hardships.”

RIHA Study – September and October 2021 Key Findings

- The percent of renters who missed rental payments increased to 9.6% in September and 10.9% in October. Missed payments were at 8.6% of renters in both June and July of this year.

- Missed rental payments in September and October were also higher than the same months in 2020 (8.4% for September; 7.9% for October).

- 17.2% of renters who missed their June payment also missed their September payment.

- Among those who missed their September rental payment, 48% had someone in their household in the labor force.

- The percent of renter households receiving permission from their landlords to delay or reduce payment has trended down from almost 20% at the start of the pandemic to 10% in September 2021. There was an uptick in October to more than11%.

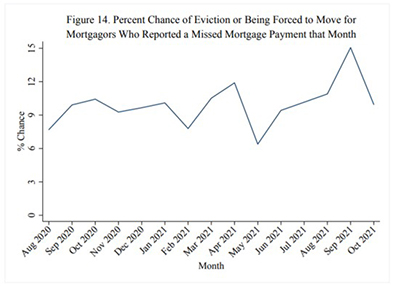

- The share of homeowners who missed their mortgage payments stood at 3.2% in September and 3.8% in October. This compared to 3.8% in July and 7.8% in July 2020.

- This is also lower than the corresponding months in 2020 (7% for September and 5.7% for October).

- 54.2% of mortgagors who missed their June payment also missed their September payment.

- Among those who missed their September mortgage payment, 58% had someone in the labor

–force.

- The percent of mortgagors who received permission from their lenders to delay or reduce payments has trended down from 25% in May 2020 to approximately 12% in September and October.

- The percent of mortgagors who received unemployment insurance benefits continued to trend down to just over 1% in October.

RIHA’s research contains data from an innovative household survey from the Understanding America Study, an internet panel survey of more than 8,000 households specially tailored to study the impact of the pandemic. Authored by Engelhardt and Michael D. Eriksen, Associate Professor of Real Estate at the University of Cincinnati, the study provides close to real-time economic data on the rapidly evolving financial consequences of the pandemic by following the same set of households from before the outbreak through the end of October.

The results for July through October are based on UAS surveys 348, 350, 394 and 411, which give full-month payment coverage for September and October, partial-month payment coverage for July and no coverage for August. Findings were previously released in August (second-quarter 2021 findings), May (first-quarter 2021 findings), February (fourth-quarter 2020 findings), October 2020 (third-quarter 2020 findings), and September 2020 (second-quarter 2020 findings).

RIHA is a 501(c)(3) trust fund. RIHA’s chief purpose is to encourage and assist – through grants to distinguished scholars and subject matter experts, educational institutions, research facilities and government organizations – establishment of a broader-based knowledge of mortgage banking and real estate finance. You can find additional studies on RIHA’s website: http://www.housingamerica.org.