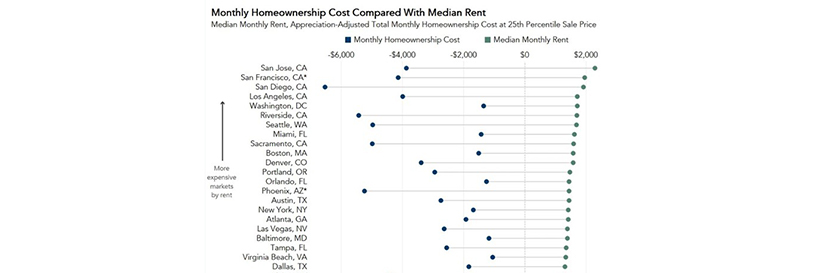

Owning a Home Cheaper Than Renting in All 50 Top U.S. Markets

(Chart courtesy First American Financial Corp., Santa Ana, Calif.)

The age-old question in real estate: owning versus renting. According to First American Financial Corp., Santa Ana, Calif., for the time being, owning is winning.

In her analysis, First American Deputy Chief Economist Odeta Kushi said after accounting for the total monthly homeownership cost and comparing it with the median rent by market, renting was a better financial choice in 35 out of the top 50 markets in the second quarter. However, when accounting for the appreciation benefit in our rent versus the First American analysis, it was cheaper to own in every one of the top 50 markets, including the two most expensive rental markets, San Francisco and San Jose, Calif.

The analysis noted when potential first-time home buyers consider making the transition to homeownership, they ask themselves whether it makes more financial sense to keep renting, or to buy. The pandemic has undoubtedly impacted that calculation. Annual house price appreciation skyrocketed during the pandemic, reaching an average of 17.5 percent annual growth in the second quarter of 2021, as demand for homes continued to outpace supply.

Meanwhile, growth in rent prices, which had slowed down in 2020 as rental demand fell, came roaring back in the second quarter. The median rent in the U.S. jumped 4 percent between the first and second quarters, the highest quarter-over-quarter pace since 2014, according to Zillow.

“The cost to rent is relatively straightforward – it is the amount of rent paid by the tenant every month,” Kushi said. “The cost of owning, on the other hand, is made up of multiple pieces – it includes taxes, repairs, homeowner’s insurance and the monthly mortgage principal and interest payment.”

Kushi said though mortgage rates have pulled back in recent weeks, they are expected to rise in the future and that will mean higher monthly payments for the same loan amount. “House price appreciation will likely remain elevated in the coming months, but eventually it will moderate from the pace we saw in the second quarter,” she said. “Nonetheless, this analysis demonstrates that the wealth-building effect of home equity is a powerful factor in the homeownership decision. When your home pays you, it makes more sense to buy than to rent.”