Single-Tenant Net Lease Cap Rates Drop to New Lows

Cap rates in the single-tenant net lease retail, office and industrial sectors reached record lows in the third quarter, reported Boulder Group, Wilmette, Ill.

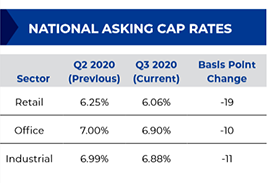

Cap rates compressed by 19, 10 and 11 basis points, respectively, for retail, office and industrial single-tenant net lease assets compared to the second quarter. Retail cap rates fell to 6.06 percent, office cap rates to 6.90 and industrial cap rates finished September at 6.88 percent.

Boulder attributed the cap rate compression to the Federal Reserve’s recent announcement suggesting interest rates will remain near zero at least through 2023. “Combining that [the Federal Reserve announcement] with a ‘flight to quality’ by real estate investors caused cap rate compression, especially for strong credit and essential net leased assets,” said Boulder Group Senior Vice President John Feeney in the firm’s Third Quarter Net Lease Market Report.

As the COVID-19 pandemic slows the real estate market, net lease investors have started limiting the type of properties they seek to acquire, the report said. “Sellers of retail assets that experienced the greatest negative impact included movie theaters, gyms and second-tier casual dining,” Boulder said. “Accordingly, owners of these assets are holding from the market as they are uninterested in selling at unfavorable pricing.” The supply of net lease properties declined sharply–nearly 10 percent–during the third quarter.

As supply has decreased, investors have moved toward assets with high-quality tenants and long-term leases. Properties with long-term leases to investment-grade tenants are in the highest demand, Boulder said. The retail sector’s 19-basis-point cap rate drop represented its largest move since 2014 as private and 1031 exchange investors aggressively sought the lower priced assets this sector provided. “Consequently, sellers of high-quality net lease properties priced assets to a level not previously seen as they look to take advantage of investors more conservative acquisition criteria,” the report said.

Net lease transaction volume for the year will likely be significantly lower than last year due to COVID-19, Boulder said. “Investors will be carefully monitoring COVID-19, the economy and the upcoming election as each individual aspect could significantly alter the net lease landscape,” the report said. “[But] despite the normal hesitancy of buyers during an election year, the majority of net lease participants expect fourth quarter transaction volume to be the strongest quarter of the year.”