Life Insurers’ Commercial Mortgage Returns Stabilize, Credit Concerns Remain

Trepp, New York, said returns for life insurance commercial mortgages stabilized in the third quarter, but noted credit concerns remain.

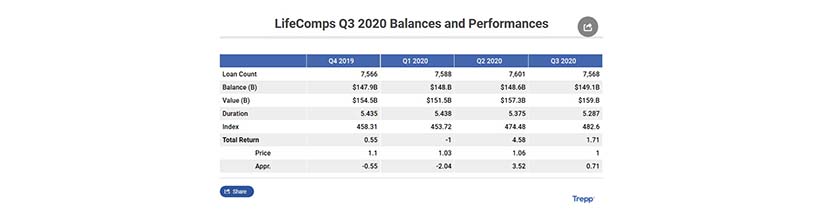

Commercial mortgage investments held by life insurance companies posted a positive 1.71 percent total return during the quarter, down from 4.58 percent in the second quarter and negative 1 percent in the first quarter. Income contributed 1 percent and appreciation added 0.71 percent to the third quarter’s total.

“After two consecutive quarters with large swings in returns, the volatility in valuations caused by the pandemic appears to have receded,” said Russell Hughes, Head of Data Consortia Initiatives at Trepp. “While interest rates remain near record lows, the persistence of credit concerns continues to dampen appreciation returns,” Hughes said.

Hughes noted credit concerns remain. “Lenders are continuing to grant deferrals and forbearance,” he said. Loans with an outstanding balance of $3.9 billion had $33 million in interest capitalized, up slightly from the second quarter when loans with an outstanding balance of $3.7 billion had $31 million in capitalized interest. The overall delinquency rate remained unchanged from Q2 at 0.06 percent.

Life company commercial mortgage charge-offs remained very low at 0.009 percent, but increased significantly from $6 million in the second quarter to $13 million in the third. While the net specific reserves for the overall portfolio decreased by $4 million, after accounting for loans with charge-offs and portfolio exits, the specific allowance on existing loans increased by $9 million.

Last month Fitch Ratings, New York, said life insurance companies could see higher losses on commercial mortgage loans than they saw during the Great Recession, reflecting both the severity of the pandemic fallout and the slow pace of the expected recovery.

On a rolling four-quarter basis, income contributed 4.26 percent while price added 1.62 percent for a total return of 5.88 percent, Trepp said. Treasury yields remain low, which is fueling price gains.

Of the four major property types, multifamily properties performed best over 12 months with a total return of 7.18 percent, followed by industrial at 6.48 percent, and office at 5.77 percent.

Trepp’s LifeComps Index tracked nearly 7,500 active loans with a $149 billion aggregate principal balance. The weighted-average duration equaled 5.29 and the average reported loan-to-value was 50 percent.