FHFA Holds GSE Affordable Housing Goals Steady in 2021

The Federal Housing Finance Agency yesterday announced its 2021 affordable housing goals for Fannie Mae and Freddie Mac will remain the same as they were in 2020. It also seeks input about future housing goals rulemaking.

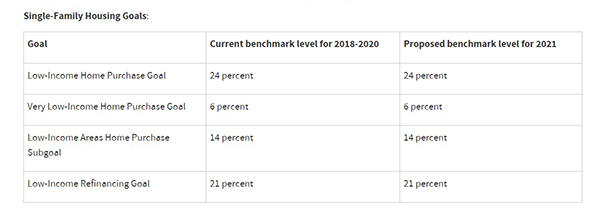

Due to economic uncertainty from the COVID-19 pandemic, FHFA announced the benchmarks for calendar-year 2021 only, and those levels will remain the same as they were for 2018-2020. The current benchmarks had been set to expire on December 31.

The final rule established both single-family and multifamily housing goals for Fannie Mae and Freddie Mac.

To meet a single-family housing goal or subgoal, the percentage of mortgage purchases by an Enterprise that meets each goal or subgoal must exceed either the benchmark level set in advance by FHFA or the market level for that year. The market level is determined retrospectively each year, based on the actual goal-qualifying share of the overall market as measured by FHFA based on Home Mortgage Disclosure Act data for that year.

To meet a multifamily housing goal or subgoal, an enterprise must purchase mortgages on multifamily properties (properties with five or more units) with rental units affordable to families in each category, as well as a subgoal for properties with 5-50 units.

FHFA also published an advance notice of proposed rulemaking seeking input on issues it may address in future housing goals rulemaking. The agency said it plans to issue a proposed and final rule during 2021 that will establish housing goal benchmarks for 2022 and beyond. This notice of proposed rulemaking gives the public an opportunity to weigh in on issues that will help ensure the housing goals benchmarks continue to effectively support affordable housing.

The notice and instructions on how to submit responses can be found here. FHFA must receive responses on or before February 28, 2021.

Click here for more information about the Enterprise housing goals.