Love Funding Secures $28M for Adaptive Re-Use, Multifamily

Love Funding, Washington, D.C., closed bridge and permanent loans totaling $27.7 million in Wisconsin and Tennessee.

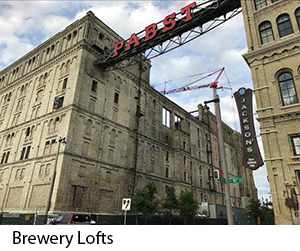

In Milwaukee, Love Funding Senior Director Holly Bray secured a $15 million rehabilitation and mini-permanent loan for Brewery Lofts, an adaptive re-use of the Pabst brewery campus’s Malt House and Malt Elevator buildings.

Built in 1882, the two buildings are part of the larger Pabst Brewery neighborhood redevelopment, a historic complex that covers more than 20 acres over six city blocks. Upon completion, Brewery Lofts will offer 118 market-rate units with one- and two-bedroom lofts in downtown Milwaukee.

Love Funding parent company Midland States Bank supplied the financing. In addition to the bridge loan, owner Milwaukee Pabst Holdings LLC will receive federal and state historic tax credits to redevelop the two buildings.

Love Funding also closed a $12.7 million acquisition loan for St. Peter Manor, an affordable age-restricted apartment community in Memphis, Tenn. Senior Director Tammy Tate secured the loan through HUD’s 223(f) loan insurance program, which provided the development team low-rate, long-term non-recourse financing to pay off its existing loan, fund $9.3 million in repairs and provide a permanent financing solution for the mortgagor.

St. Peter Manor has 283 units in one 10-story building. The community was awarded 9 percent Low-Income Housing Tax Credits through the Tennessee Housing Development Agency. It will remain an affordable community that serves seniors with incomes at or below 60 percent of area median income and offering Section 8 rental assistance for at least another 20 years.

Wesley Housing Corp. of Memphis, a faith-based non-profit that owns and/or manages more than 2,000 units of elderly and assisted living projects in Tennessee, Kentucky and Arkansas will manage the property.