MBA Chart of the Week: Transition from LIBOR

Source: Mortgage Bankers Association.

The vast majority of commercial and multifamily mortgage lenders report they are working on the transition away from LIBOR, but the devil is in the details. Most firms are already taking steps, but they also report relying on regulators and industry bodies to make decisions before they take certain actions

Released last week, MBA’s survey of commercial/multifamily mortgage lenders found that 92 percent of respondents have begun planning for the transition away from LIBOR and 77 percent have already adjusted LIBOR fallback language in all new loan documents. More than half–56 percent–say they are right on track in preparing for a future without LIBOR (https://www.mba.org/mba-newslinks/2019/june/mba-newslink-tuesday-6-4-19/mba-survey-on-libor-transition-finds-mix-of-preparation-uncertainty-among-commercial/multifamily-real-estate-firms?_zs=WqkwB1&_zl=hiK85).

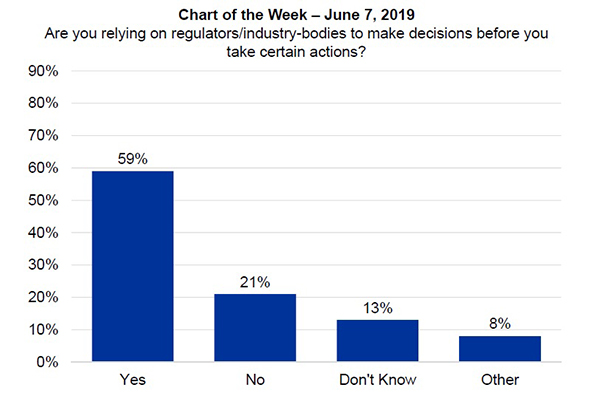

When it comes to detailed plans for the transition, surveyed firms’ responses are more varied. For example, just less than half (41 percent) said they anticipate using the Secured Overnight Financing Rate (SOFR) as the alternative to LIBOR. When asked if they will follow the recommendations of the Alternative Reference Rates Committee (ARRC), 59 percent said they don’t know. More than half of firms (59 percent) surveyed said they are relying on regulators/industry-bodies to make decisions before they take certain actions.

MBA is working with member firms to prepare for the LIBOR transition. For information about this survey, contact Jamie Woodwell. To learn more about MBA’s LIBOR efforts for the commercial and multifamily markets, contact Andrew Foster; for MBA’s single-family efforts, contact Dan Fichtler.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)