MBA Chart of the Week: Number of Owner and Renter Households

Source: MBA; Harvard Joint Center for Housing Studies.

Each year, the Harvard Joint Center for Housing Studies releases its State of the Nation’s Housing report (http://www.jchs.harvard.edu/state-nations-housing-2018?_ga=2.7349617.270685195.1545402863-408710546.1543250311), of which MBA’s Research Institute for Housing America (https://www.mba.org/news-research-and-resources/research-and-economics/research-institute-for-housing-america) is a sponsor.

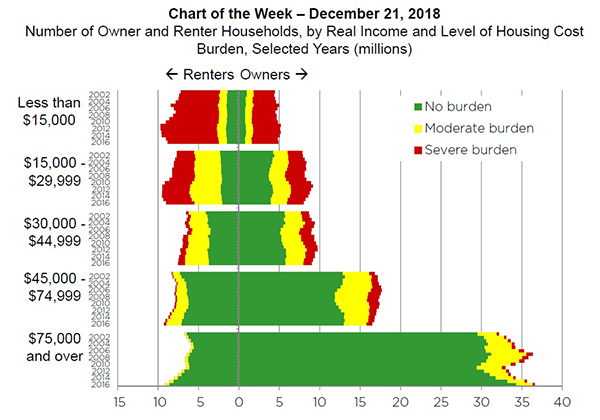

One of the key statistics is the number of households facing moderate (more than 30% of income goes to housing) and severe (more than 50% goes to housing) burdens. The numbers tell an important story about affordability, and also about how households and the housing market interacted before, during and after the Great Recession.

A few areas of note: 1) before the recession, a shift from renting to owning among households earning $45,000 and more. 2) during the recession, growth in the number of households earning less than $30,000 (a large share of whom were renters facing severe burdens), and a decline in households earning more than $75,000 (a large share of whom were owners and had previously faced no burden), 4) After the recession, a slow decline in the number of households earning less than $30,000; a rapid increase in the number earning $75,000 or more (both renters and owners); and a shift from owning to renting among households earning between $30,000 and $75,000.

Recent data from the Census Bureau’s Housing Vacancy Survey (https://www.census.gov/housing/hvs/index.html) shows the home-ownership rate has grown over the past year with the addition of 1.5 million owner households. We look forward to the next State of Nation’s Housing report to see where the story goes from here.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)