MBA Chart of the Week: Commercial Real Estate Mortgage Debt Outstanding and LIBOR

Sources: MBA; Merrill Lynch; Pierce, Fenner & Smith; Fannie Mae; Federal Reserve.

The London Interbank Offered Rate (LIBOR) is a leading reference rate for adjustable-rate loans in the United States and around the world and is targeted to sunset at the end of 2021.

Randal Quarles, the Federal Reserve’s Vice Chair for Supervision, recently noted, “We have only a little over 2.5 years until the point at which LIBOR could end, and the transition needs to continue to accelerate.”

How, and to what markets may transition is a topic of active discussion throughout the industry. Leading much of the dialogue, the Federal Reserve convenes the Alternative Reference Rates Committee, which is working to stand up an alternative rate – the Secured Overnight Financing Rate–and to work through a range of transition issues.

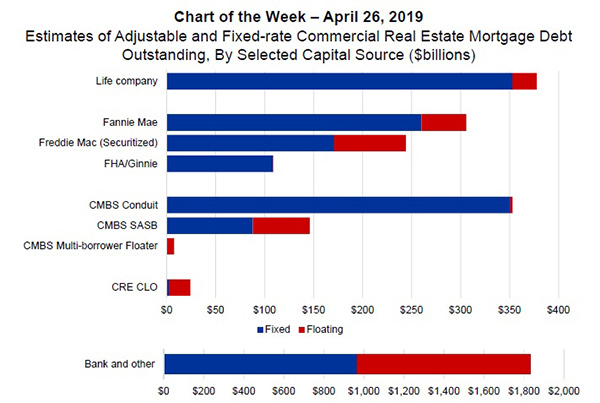

Within commercial real estate finance markets, a LIBOR transition would have broad–and varied–impacts. Adjustable-rate mortgages are estimated to make up just less than one-third of the total balance of mortgage debt outstanding. The bulk of that adjustable-rate debt is held on bank balance sheets, but floating rate debt also makes up roughly 30 percent of Freddie Mac’s securitized multifamily debt, and 15 percent of the mortgages guaranteed by Fannie Mae.

In the CMBS market, only 1 percent of conduit debt is floating rate, but so is 40 percent of single-asset/single-borrower mortgage debt, and 96 percent of multi-borrower floater debt. Ninety-one percent of mortgages backing CRE CLOs–driven by investor-driven lenders such as mortgage real estate investment trusts and debt funds–is floating rate, as is 7 percent of commercial mortgage debt held by life companies.

A transition from LIBOR will be a multi-year, industry-wide event. To learn more about LIBOR, and to get involved in MBA’s transition planning, contact Dan Fichtler (single-family: dfichtler@mba.org); or Andrew Foster (commercial/multifamily: afoster@mba.org). To learn more about MBA’s research on commercial and multifamily real estate markets, contact Jamie Woodwell (jwoodwell@mba.org).

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)