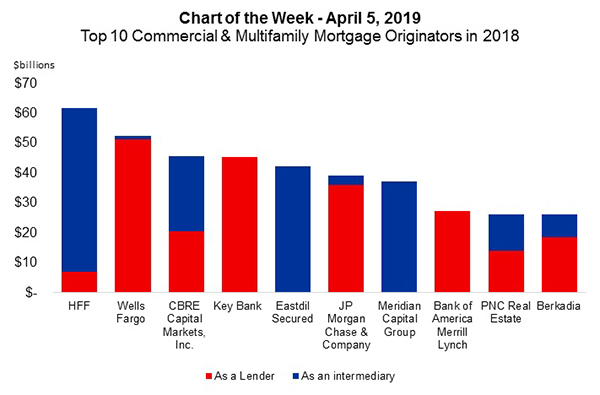

MBA Chart of the Week: Top 10 Commercial/Multifamily Originators in 2018

Source: MBA 2018 Commercial/Multifamily Annual Origination Rankings.

MBA recently released its annual 2018 Rankings of Commercial/Multifamily Mortgage Firms’ Origination Volumes.

Last year was another strong year for lending and borrowing; the following firms were the top commercial/multifamily mortgage originators: HFF; Wells Fargo; CBRE Capital Markets Inc.; Key Bank; Eastdil Secured; JP Morgan Chase & Co.; Meridian Capital Group; Bank of America Merrill Lynch; PNC Real Estate; and Berkadia.

The report tracks 136 firms’ total originations activity, and includes breakouts for loans in which the firm acted as a lender (closing the loan in their own name) and as an intermediary (in which the loan was closed in someone else’s name). Few firms fall into only one of the two camps, with most originating some loans as a lender and others as an intermediary. Many of the loans closed in a firms own name (as a lender) may also end up being sold to another entity.

The top capital sources in the market include commercial bank and life company portfolios, the government-sponsored enterprises (Fannie Mae and Freddie Mac) and FHA, and the commercial mortgage-backed securities market.

The report is available for purchase through MBA’s Online Store: www.mba.org/originatorrankings.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)