MBA Chart of the Week: Multifamily Lending in 2017

Source: Mortgage Bankers Association Annual Report on Multifamily Lending.

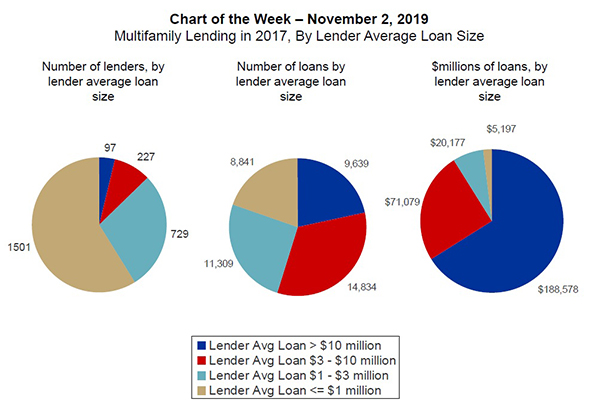

The multifamily mortgage market is large and diverse, with 2,554 lenders making 44,623 loans totaling a record $285 billion in 2017 involving loans ranging in size from thousands of dollars to hundreds of millions of dollars.

A small number of dedicated commercial real estate lenders drive the overall dollar volume of multifamily mortgage lending. In 2017, 97 firms had average loan sizes greater than $10 million. These firms accounted for just 4 percent of the total number of firms making multifamily loans, but 22 percent of the number of loans and 66 percent of the total dollar balance borrowed.

At the other end of the market, 1,501 firms had average loan sizes of $1 million or less. These firms accounted for a full 59 percent of the number of firms, but just 20 percent of the number of loans, and only 2 percent of the total dollar amount borrowed. Nearly one-in-four multifamily loans was for $500,000 or less.

For more details, see MBA’s recently released Annual Report on Multifamily Lending: https://www.mba.org/2018-press-releases/october/mba-multifamily-lending-increased-6-percent-to-a-new-high-of-285-billion-in-2017.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)