MBA Chart of the Week: GSE Multifamily Activity

Source: MBA, Fannie Mae, Freddie Mac.

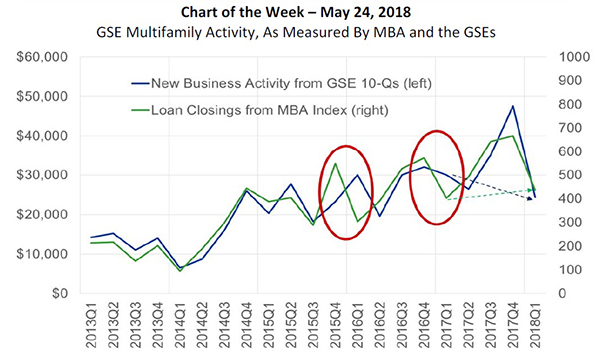

The Mortgage Bankers Association’s commercial/multifamily mortgage bankers origination index reported an 8 percent increase in the dollar volume of loans closed for Fannie Mae and Freddie Mac between Q1 2017 and Q1 2018. According to the GSEs’ 10-Qs, their multifamily business activity declined 19 percent over that period.

Who’s wrong? In this case, nobody.

MBA’s origination index measures activity based on when loans are closed by the originating mortgage banking firms, while the GSEs–as secondary market players–measure their activity based on when they fund the purchase of those loans.

Often, such differences in timing don’t have a material impact on the reported flow of activity. In recent years, however, the GSEs and market players have adjusted their deliveries of loans to conform to the multifamily lending caps imposed by the Federal Housing Finance Agency. Such timing disparities have led to significant differences during the fourth and first quarters of each year between the MBA numbers (tracking loan closings) and the GSE numbers (tracking loan fundings).

In the case of Q1 2018, the differences can be traced back to Q4 2016 and the fact that a share of the loans closed then were not funded by the GSEs until Q1 2017. That meant that the Q1 2017 funding numbers for the GSEs–buoyed by those extra loans–were, relatively, higher than the volume of loans closed as reported by MBA.

Now, when comparing Q1 2018 numbers back to then, the higher base for GSE fundings shows a decline, while the lower base for loan closings leads to an increase.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)