MBA Chart of the Week: Q1 Changes in Commercial/Multifamily Mortgage Debt Outstanding

Source: MBA CREF Database.

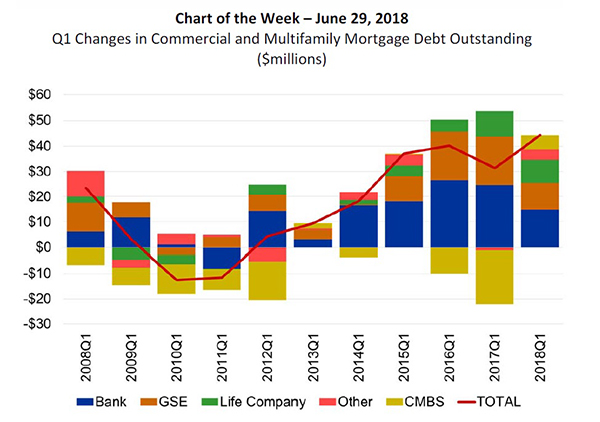

During the first three months of 2018, commercial and multifamily mortgage debt outstanding (shown by the red line in the chart) increased more than during any other first quarter since before the Great Recession.

Interestingly, this year’s increase was driven by the commercial mortgage-backed securities market, which added $6 billion of mortgages to its balances. This is a sharp contrast to the $21 billion decline over the same period in 2017. For the first time since 2007, CMBS has seen three straight quarters of increase.

Commercial/multifamily mortgage debt outstanding increased by $44.3 billion in the first quarter, as all four major investor groups increased their holdings. That is a 1.4 percent increase over fourth quarter 2017, according to MBA’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

Total commercial/multifamily debt outstanding rose to $3.21 trillion at the end of the first quarter, while multifamily mortgage debt outstanding rose to $1.3 trillion, an increase of $19.3 billion from fourth quarter 2017.

To learn more, download MBA’s Commercial/Multifamily Mortgage Debt Outstanding report, free of charge: https://www.mba.org/news-research-and-resources/research-and-economics/commercial/multifamily-research/commercial/multifamily-mortgage-debt-outstanding?utm_source=Informz&utm_medium=Email&utm_campaign=mba.org&_zs=A3KNA1&_zl=fQbW4.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)