MBA Chart of the Week: CMBS/Bank Delinquencies

Source: Federal Deposit Insurance Corp.; Wells Fargo Securities.

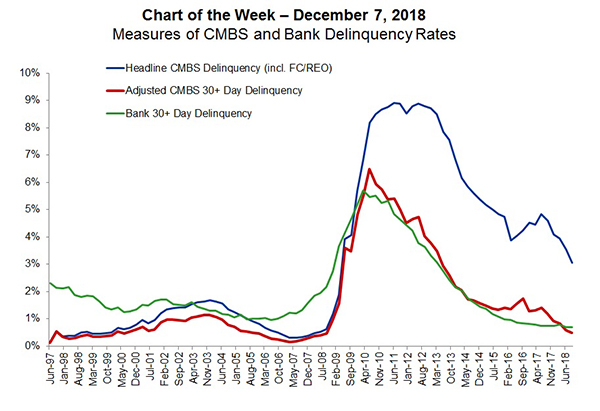

In the commercial and multifamily mortgage markets, different capital sources track delinquency rates in different ways, and for a host of good reasons. Many capital sources, including banks, calculate delinquencies up to the point where an economic loss is recorded.

With the resulting charge-down or charge-off, the delinquent loan is removed from both the numerator and denominator of the delinquency rate. The measure is well-suited for investors, as loan charge-offs are measured on the balance sheet and the delinquency rate acts as a gauge of potential upcoming distress.

The commercial mortgage backed securities market operates differently. In the CMBS market, there is no mechanism to charge a loan down or off. Instead, bond prices fluctuate to account for past and expected loan performance. For CMBS investors, the “all-in” delinquency rate–which includes loans that are in foreclosure and real estate owned,as well as defeased loans–is the coin of the realm.

The result is different headline rates that make the delinquency rate for CMBS appear significantly larger than that for other capital sources. This is especially the case now as the CMBS market continues to work through legacy loans in foreclosure/REO.

Adjusting the CMBS delinquency rate to look more like that of other capital sources, by removing loans in foreclosure and REO from the numerator and denominator and defeased loans from the denominator, shows that the CMBS loan delinquency rate has been roughly on par with that of banks–where commercial and multifamily mortgages were the best performing loans on bank balance sheets during the Great Recession and are currently at record lows.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)