MBA Chart of the Week: U.S. Treasuries and Agency MBS on Fed’s Balance Sheet

Source: Federal Reserve Economic Data; Federal Open Market Committee Statement.

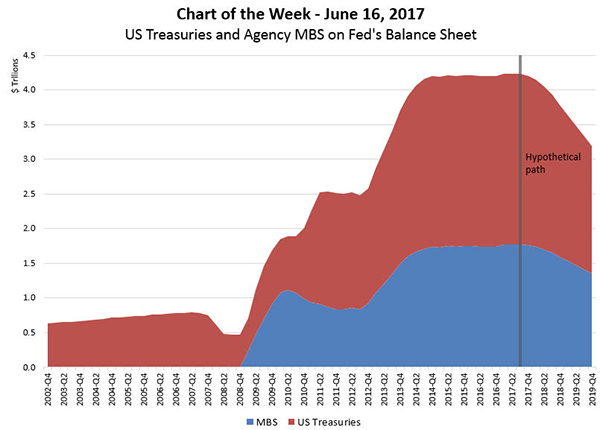

As MBA had anticipated in its forecast, the Federal Reserve proceeded with another 25 basis point rate hike and announced plans to begin unwinding its balance sheet this year. In doing so, it will limit the amount of securities that will be allowed to run-off each month.

This week’s chart shows a possible path of decline for Treasuries and mortgage-backed securities held on balance sheet assuming that the allowable cap is met each month, starting in the fourth quarter of this year. With lower caps for mortgage backed securities compared to Treasuries, it is possible that there will be less widening in mortgage spreads than previously estimated.

The Fed has not yet determined how much it will reduce its holdings in total, noting only that the target level of reserves will be less than the current $4.2 trillion and most likely greater than reserves held prior to 2009. The plan emphasizes that the balance sheet will be reduced in a gradual and predictable manner if economic growth and inflation continue as expected.

The statement also reaffirmed that the target fed funds rate is still the primary means for monetary policy action. Markets viewed the statement as more hawkish than anticipated, with 10 Year Treasury rates rising slightly following the statement.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)